As consumers have adopted third-party digital apps and services to better manage their financial lives, open finance has become a critical digital transformation priority for financial institutions. Today, it’s more important than ever before with almost two-thirds of consumers globally using at least one fintech app and an increased amount of financial activity happening digitally in the midst of COVID-19.

Yet it remains challenging for financial institutions to implement an open finance strategy that enables third-party developers to build applications and services leveraging customer-permissioned financial data. The sheer amount of disparate technology involved in financial services — an average customer interaction can touch up to 35 distinct systems — as well as the rapidly growing fintech ecosystem means that financial institutions need a way to deliver third-party access to financial data at scale with security and customer consent top-of-mind.

This is why MuleSoft and Plaid are excited to announce a new partnership that will enable financial institutions to more easily achieve an API-based data access strategy via Plaid Exchange, Plaid’s new open finance platform.

What is Plaid Exchange?

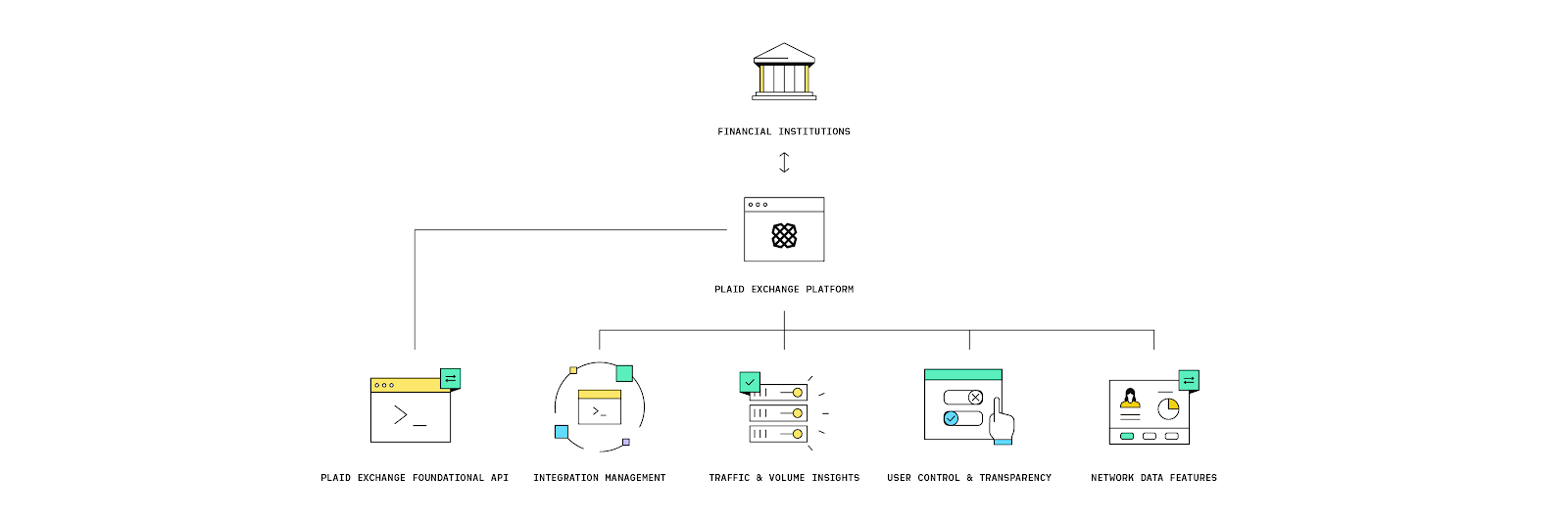

Plaid Exchange gives financial institutions, from banks to wealth management firms, an open finance platform including critical tools to manage the reliable and secure data connectivity that customers demand. At the heart of this platform is the ability for consumers to maintain control and transparency into where and how their financial information is permissioned and shared with third parties.

With Plaid Exchange, financial institutions can:

- Easily build an API strategy by leveraging an out-of-the-box API solution that can be implemented quickly and efficiently.

- Partner with Plaid for critical tools needed for developer testing, risk management, and implementation.

- Leverage token-based authentication to provide a more secure connection for users.

These capabilities make it possible for financial institutions to empower their customers to give consent to share their financial information with popular third-party apps and services like Venmo, Coinbase, and Microsoft’s Money in Excel, which are among the many digital financial tools that consumers use to manage their financial lives.

Easily get started with Plaid Exchange

MuleSoft and Plaid have worked together to create a MuleSoft-compatible API description and standardized data model. Together, these assets enable financial institutions who use MuleSoft’s Anypoint Platform to easily get started implementing Plaid Exchange. The data model that Plaid has developed follows API design best practices and is simple to build — the only effort required is to download the API description using the APIkit feature in Studio, and plug into the microservices or banking APIs used by the financial institution.

To get started, reach out to MuleSoft and Plaid about your open finance goals. We’ll work closely with you to build and test the Plaid Exchange platform using the MuleSoft API spec, and help you deploy the solution to give your customers access to the thousands of third-party apps Plaid supports.

Whether your financial institution is just getting started or is further along on the open finance journey, this joint solution can help securely scale your strategy with simplified connectivity that makes it faster and easier to bring the benefits of open finance to your customers.

Unlock the potential of open finance

If you’re interested in using MuleSoft to get started with Plaid Exchange, contact us or find more information here.