Technology is reshaping the business landscape with every next technological evolution. AI agents are rapidly emerging, driving the most significant technical revolution of a generation. While agentic technology holds immense potential, it’s still in its early stages, leaving many businesses overwhelmed. At the board level, leaders face mounting pressure to adopt AI to drive efficiency and reduce costs. But amid the excitement, a critical question arises: where do we start without putting our brand at risk?

To help you get started in your agentic journey, we’ll explore the Agentic Enterprise Maturity Model, how to simplify the challenges of AI adoption from a business process perspective, and what technological capabilities are required at each maturity level. To illustrate how to incrementally adopt AI within your business context, we will use a commercial loan approval process as a use case.

What is the Agentic Enterprise Maturity Model?

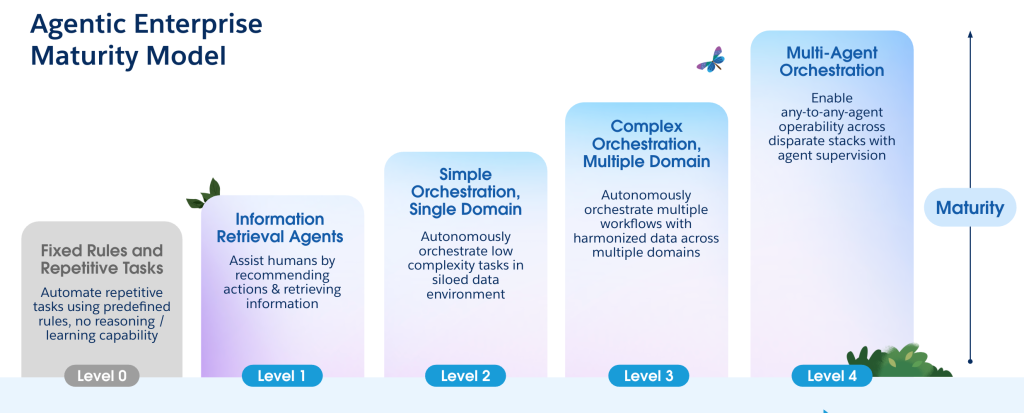

While the agent world is rapidly emerging with various technical approaches, the Agentic Enterprise Maturity Model is designed to be business-oriented, simplifying concepts by categorizing agents based on complexity. Each level represents increasing sophistication, solving progressively complex problems. The model recognizes that companies are at different levels in their agentic shift, helping them assess their current level and build the capabilities to move forward.

The model consists of four progressive levels (Level 1 to Level 4), with Level 0 representing the pre-GenAI state – basic rule-based chatbots. These traditional bots automate repetitive tasks using predefined rules but lack reasoning capabilities, making them limited in adaptability and problem-solving.

Level 1: Information Retrieval Agents

At Level 1, AI agents function primarily as information retrieval assistants, helping users quickly find relevant information and recommend actions. Typically these are read-only assistants, pulling data from structured and unstructured sources to answer user queries using low levels of reasoning. A common example is a help desk or FAQ assistant that retrieves responses from a knowledge base to assist employees or customers.

The key problem these agents solve is the difficulty of accessing scattered data or searching through voluminous information. In many organizations, data is fragmented across multiple systems, making it time-consuming and costly for employees to find answers. Typical use cases include self-service case managers, warranty or order lookup, and customer support assistants.

The business impact of Level 1 agents is faster service resolution, improved customer satisfaction, and enhanced productivity. By reducing reliance on human support for basic queries, businesses can lower operational costs while ensuring that users get the information they need instantly.

Let’s explore a use case in financial services where an agent assists with the loan inquiry process. Imagine a customer, Emily, looking for a commercial loan to purchase equipment for a new store location. She interacts with the bank’s AI-powered assistant, asking for details about available loan options. The agent retrieves and presents relevant loan offerings, including terms, interest rates, and eligibility criteria. In this scenario, the customer remains anonymous, as the interaction is purely informational and not a personalized experience.

From a technical perspective, the bank’s AI assistant, built on Salesforce’s Agentforce platform, uses the Atlas reasoning engine to interpret customer intent and map it to the relevant topic – commercial loans. The mapped topic contains the relevant set of instructions to retrieve loan information from the appropriate source, in this case, the Data Cloud vector database, which stores both structured and unstructured data.

For data stored in platforms like SharePoint, databases, or other typical enterprise systems, MuleSoft can help unlock these data stores and provide APIs to access them.

Level 2: Simple Orchestration Agents (Single Domain)

At Level 2, AI agents move beyond information retrieval and start handling simple, low-complexity tasks within a single domain. Unlike Level 1, where agents are usually read-only, Level 2 agents can read, write, update, and autonomously take actions. These agents streamline processes that typically require human intervention, such as updating records or verifying criteria.

The primary problem these agents solve is the friction in completing simple but essential tasks. Traditionally, users might need to wait in long call center queues or navigate complex web forms just to make a small update. AI agents at this level remove these bottlenecks by orchestrating a range of functions through multiple topics (jobs to be done) and actions (a set of tools). Example use cases include appointment scheduling, predictive maintenance, and profile updates.

The business impact of Level 2 is significant time savings, increased automation, and reduced human errors. The key technology requirements for this level include well-defined APIs for system interactions, controlled security access to prevent violations, and mechanisms for human approval when necessary. As organizations refine these capabilities, they set the stage for more advanced, multi-domain agentic orchestration in the next level.

Back to our use case, Emily continues her journey by logging into her account. The agent identifies her, retrieves her customer profile, verifies her loan eligibility, and pre-fills her application. To complete the application, the agent prompts her to upload the necessary documents via a secure link sent in an email.

Behind the scenes, the agent uses multiple tools to submit the loan application. First, it retrieves the customer profile from the core banking system via MuleSoft, a unified platform for agent actions. Agent actions driven through APIs, both MuleSoft (via Topic Center) and external, are made available as topics to Agentforce from the Salesforce API Catalog. Second, it calls the loan topic to fetch relevant loan product details and submits the pre-filled application to the Loan Origination System (LOS). Finally, the agent takes action by notifying the underwriter for further assessment of the application.

Level 3: Complex Orchestration Agents (Multiple Domains)

At Level 3, AI agents evolve into multi-domain orchestrators, autonomously executing multi-step workflows that span across different systems, departments, or even external entities. These agents will use a high level of reasoning to consider multiple paths and decide the next best action.

The key problem Level 3 agents solve is the orchestration of complex processes, many of which traditionally require multi-step execution over a few days and involve human intervention. By autonomously orchestrating processes and keeping humans in the loop for exception handling, these agents can reduce processing time from days to hours or even minutes while offering a more seamless customer experience.

Example use cases include claim processing and product-service bundle purchase. Instead of customers or employees juggling multiple steps, the AI agent harmonizes the entire process, ensuring accuracy and timely execution.

The business impact of Level 3 is massive efficiency gain and reduced friction in complex operations by eliminating manual steps.

The technology requirements build upon those of Level 2, plus require well-defined access to all applications involved, robust exception handling, and clear human intervention points where necessary. This depends on thorough definition of all process steps, covering both standard and exception paths, and in some cases, the process may need to be redesigned to incorporate agents into the workflow. AI agents at this level must be able to pause, escalate, or adapt in cases of missing information, edge cases, or regulatory requirements, ensuring smooth execution.

Continuing Emily’s journey, a dispute is detected with her company, prompting the agent to notify the underwriter to place her application on hold while requesting additional information from her. After she uploads the required documents, the underwriting team reviews and resubmits the application. An hour later, Emily receives approval for a reduced loan amount (to mitigate risk exposure) along with an email prompting her to sign the loan documents.

On the backend, the agent orchestrates across multiple domains. First, it submits the loan application for KYC using the KYC topic, which calls an API from the Salesforce API Catalog. Then, the agent processes the dispute raised by KYC, calling another API to communicate with the underwriter to hold the loan processing. After identifying the additional documents needed, it calls the SMS service to notify Emily. The agent pauses the loan process until the new documents are received, then resumes the orchestration with the underwriter, LOS, and the customer to autonomously complete this complex, multi-step process.

Level 4: Multi-Agent Orchestration

At Level 4, AI agents evolve into fully autonomous multi-agent systems interacting with systems both intra- and inter-enterprise. At this level, agents can communicate with and coordinate other agents, effectively creating a self-managing AI ecosystem. This level introduces agent supervision, where AI systems oversee and direct the interactions between multiple agents to optimize business outcomes.

Multi-agent orchestration requires interoperability across heterogeneous environments, which poses interesting challenges. New communication protocols and enablers, like ontologies, are being developed to standardize interactions between agents across different domains and platforms. An example use case could be a marketing AI agent could analyze campaign results, identify high-performing strategies, autonomously place orders for ad buys, and adjust lead generation goals – creating a fully automated marketing funnel with no human intervention.

While the technological foundations for Level 4 are emerging, adoption remains aspirational at this time. First, processes must be reimagined to support autonomous decision-making by agents, backed by robust risk management systems. For technical implementation, organizations will need to retool capabilities for composability, ensuring seamless integration with business functions to enable agentic orchestration.

This level represents the future of AI-driven enterprises, where AI agents gradually take over core functions with minimal human oversight.

How businesses can get started with an Agentic Maturity Model

Now that we’ve explored the four levels of the Agentic Maturity Model, the next step is to assess your organization’s readiness and decide where to begin.

The right entry point depends on your process readiness and technical capabilities. Most organizations start at Level 1 or 2 before progressing to complex multi-domain use cases. Here are some best practices for adopting the agents effectively:

- Assess your business processes: Identify pain points, inefficiencies, or opportunities where agents can help. Look for processes that are repeatable, manual, labor-intensive, or involve frequent system switching. You may need to redesign the process to make AI the primary and identify opportunities for integrating human input.

- Evaluate risks: Determine where human oversight is needed, define handoff points, and design for both happy paths and edge cases. Pay close attention to security, guardrails, ethical needs, and regulatory requirements. Maintain an audit trail of all agent interactions and rely on human oversight early to build trust. Use feedback to refine and improve agent performance.

- Start small and demonstrate value: Start with a simple use case needing minimal data while delivering meaningful business impact. Building trust internally and with customers is key. For example, an employee-facing conversational agent for internal processes or products.

- Identify system dependencies: Ensure access to required data and systems while considering security, governance, and compliance needs. Consider agent performance, system monitoring, and fallback options when data or systems are unavailable.

- Measure success: Establish KPIs and continuously assess and refine your approach before scaling to more advanced levels. Sample metrics include time savings, case resolution rate changes, deflection rates, and customer satisfaction.

The Agentic Enterprise Maturity Model helps simplify the AI adoption challenge by approaching it from a business process perspective, enabling organizations to begin their agentic shift – helping to unlock efficiency, further innovation, and gain a competitive advantage.

To accelerate your AI adoption, MuleSoft offers Agentic Maturity Assessment workshops that help businesses assess their current state, uncover use cases, and create a readiness plan.