Imagine you’re an aspiring entrepreneur looking to open a food service business. One of the first questions you’d ask is: “What type of business do I want to open?” Is it a fine dining restaurant? Is it a food truck? Is it a catering business? Is it a coffee shop? While all of these options are easy for us to understand and enumerate, the same familiarity isn’t expected of digital businesses and product offerings.

In the same vein, enterprises often struggle to establish a clear picture of the business model for their enterprise when developing a digital product strategy. (i.e. “What type of digital business do I want to open?”).

These challenges show up differently for each enterprise and can range from “We have a lot of capabilities but don’t know where to start” to “We have a lot of product concepts but can’t develop the alignment to make progress against them.” These struggles point to a gap in your team’s understanding of business context and how the lack of a common frame of reference can drive the all too familiar situation of analysis paralysis.

Begin with business context for your API monetization strategy

While analysis paralysis is a well-known issue for solution design teams, not everyone is familiar with a standard business approach for steering clear of the stagnation and confusion that can arise from starting from a blank slate: cross-pollination. Cross-pollination is a product ideation tool where teams intentionally survey efforts and offerings from outside of their market context to look for inspiration as to what could be valuable in their industry.

There are many examples of successful cross-pollination in business contexts. These successes range from the Wright brothers leveraging bicycle know-how to make the world’s first airplane to modern dentistry borrowing space technology to improve the standard X-ray processes in your annual check-up.

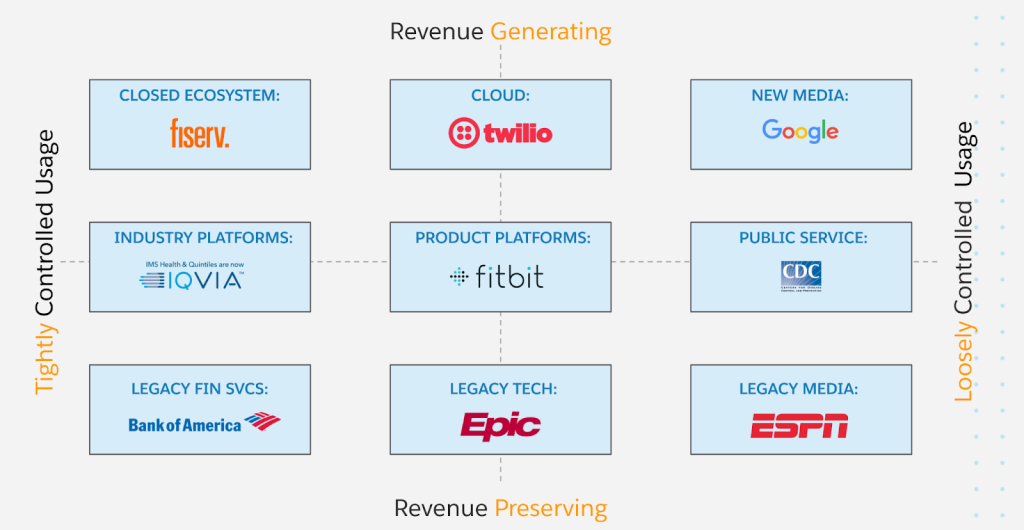

In working with customers worldwide, the MuleSoft team has developed a foundational framework to help organizations understand and leverage different business contexts. Once CIOs and organizations understand these contexts holistically, seeing and prioritizing business models becomes significantly more accessible for teams to align around. The API-monetization business context map has two dimensions.

First, from top to bottom, organizations can stratify product concepts by their ability to generate new revenue streams vs. preserving existing revenue streams. From left to right, enterprises can segment the requirements associated with their product concepts by how much control they will need over how customers will gain access to their digital products.

MuleSoft’s API monetization business context map

When contrasting these two dimensions, you can map your organization to specific types of nine contextual segments. These offerings can be categorized and associated with the offerings that are currently available for your organization’s potential customers.

Let’s take a look at each of the nine segments individually. Starting with the top row of elements in the map, from left to the right are the business contexts that mainly drive scalable revenue:

Walled Gardens

Consumers are very familiar with platforms that have become ubiquitous in their lives. This context includes consumer search, GPS navigation, social media networks, etc. However, not everyone is familiar with the set of focused platforms targeted to enable these platforms.

The most successful platforms are indispensable for certain types of businesses. Some examples you might know include Fiserv for banking and financial services and Cox Automotive for automotive marketing and retailing services. These companies have reached a critical mass with a density of features, content, and users/actors to achieve network effects that deliver value to nearly every transaction.

Cloud-based widgets

A handful of digital-native enterprises are creating cloud-based widgets. In the walled garden context, not every enterprise has needs that a banking platform can address. That is where the makers of cloud-based widgets come in since they manage more organizations in the market.

There’s a class of services intrinsic to running nearly every type of business, from computing to telecommunications, payments, and beyond. This variety means it is more accessible to monetize across industries as long as your organization can demonstrate a mastery of software production and resiliency.

Offerings like AWS, Twilio, and Stripe have created demand by taking complex computing and transactional problems and simplifying them through a packaged API offering. These offerings are designed and marketed to a developer community for B2B use, where the offered APIs are composed of consuming applications for further value generation by the consuming business.

New media platforms

This top-right corner of the map shows the walled garden context. In the Walled Garden, all access is tightly controlled. While in the new media world, usage is open to all. However, this freedom with access doesn’t necessarily translate to an easy path to monetization.

To derive revenue in this context, the content within the platform requires a tight degree of control to remain uniquely valuable. These new media platforms include Twitter, Facebook, and Google, and all hold content that is generally unique to their platforms. This content draws in their audience and is monetized via advertising.

Marketing content via APIs only works when your content is uniquely valuable and not easy to scrape and duplicate. For example, the content changes every minute on Twitter and Facebook, and it has little value in driving user engagement outside the context of the origin platform.

A critical requirement for this type of offering is a set of terms and conditions and the capability to monitor and pursue illicit use. Offerings in this context are composed of embeddable widgets that drop into any web or mobile experience. Google Maps is an outstanding example of a digital product that has value in both the Cloud-based Widget context and the New Media context.

Continuing down the map and into the middle row, from left to right, are the business contexts using API capabilities to preserve and grow revenue via enhanced platform stickiness or product value. The players aim to move upward and derive net new revenue via API channels. But often, they have yet to establish an API value stream that can drive either an independent purchase or a significant acceleration of the enterprise’s economic model:

Industry platforms

Like the Walled Gardens in the upper row of the map, Industry Platform organizations target a specific B2B audience. However, while these organizations may have offerings in the B2C space, their API offerings are more focused on scaled business consumers.

These platforms have the critical mass of users, features, and functions to deliver a compelling value proposition. However, they also hold a more comprehensive set of competitors, requiring a more deliberate approach to successfully create and market API products that drive significant revenue and transactional growth.

Product-centric platforms

Unlike the digital natives in the Cloud-based Widgets context, Product-Centric Platform organizations don’t exclusively focus on tools composed of consuming applications for further value generation. So while this business context’s API offerings will be composed, they differ since they are tied to an existing application or product. Examples include Roku streaming media players, the Salesforce CRM offering, and the Fitbit fitness tracker.

The APIs created by these organizations are conceived and designed to enhance value, drive consumer affinity, and deepen user engagement with a previously purchased product. Enterprises with this offer type focus on building an ecosystem to push a product value proposition. Therefore, they require an increased focus on developer relations to make this business strategy work since it typically relies on a community of developers to make something that end consumers will find valuable.

Public service

Offerings created by organizations in this zone are often driven more by purpose than profit. These organizations with an established charter and mission serve society at large and typically bring these services to market. Some examples are the CDC which aims to drive public health, NPR seeks to provide a more informed and invigorated public, and Donors Choose to support teachers and public schools with funding gaps.

Most APIs in this zone are free and open to the public. This freely-to-use model aligns with the grander social purpose of these enterprises. However, while usage and consumption are easier to generate with free-in-perpetuity offerings, a challenge can arise in developing the enterprise support to operate and continually improve free products and services.

In the bottom row of the context map, organizations almost exclusively offer APIs to preserve existing revenue. As a result, these organizations do not have an immediately actionable path to leverage their capabilities and relationships to drive new organic revenue.

Legacy services

Companies in this zone have highly mature offerings that are more vulnerable to disruption. These commoditized offerings invite price competition on a smaller feature set, forcing existing players into a posture focused on preserving revenue and market share. API offerings in this context don’t often generate significant new revenue, as they are part of the existing service bundle.

One tactic used by disruptors that have shown some success in this zone is to create highly-targeted niche offerings that provide significant value to audiences engaged with the service provider. While this l self-unbundling tactic doesn’t drive substantial direct revenue immediately, it does set the stage to move upward by extending the line of offerings that potentially unlocks more impactful revenue opportunities.

Legacy tech

Pre-cloud tech organizations that have not made the transition to SaaS/PaaS business models populate this zone. These enterprises offer commoditized feature sets sold in bundles targeted to industry-specific use cases. These product suites are similar to the Walled Gardens in the top left of the context map. And they are designed to achieve vendor lock-in through non-interoperability.

The difference from Walled Gardens is that these offerings don’t have a transactional flywheel that generates revenue through the use. Without a mechanism to drive best-in-class network effects or direct transactional value, these organizations are forced to deliver API-based integration capabilities as a defensive maneuver. Legacy Tech APIs defend against unbundling, but only if they’re free or priced so low that they aren’t at risk of cannibalizing existing revenue.

Legacy media

The bottom right corner on the map is the least enviable position for enterprises. These companies have attempted to launch paid API offerings, only to backtrack and shut them down almost immediately. Most notable examples include ESPN and Edmunds, as detailed in MuleSoft’s Develop a winning API product strategy white paper.

Unlike the enterprises in the New Media category, these organizations do not have the level of control of their content to remain uniquely valuable. However, these organizations are not without options. There is potential to move diagonally across the grid into Product-centric platforms by harvesting their capabilities unique to them. This shift could come from affinity or affiliate programs for enthusiasts and algorithmic insights from large data sets.

The path to getting big often starts small

Once your enterprise has a grounding in the type of digital business they’re interested in exploring, you’re ready to start the dialogue on the next set of tasks:

- Map out where and how value is exchanged between parties in the ecosystem and how the actors in the system will harvest that value.

- Align your leadership and delivery teams on an API business model and test it out with trusted partners

- Define and run a value test to solidify a pricing model and price point for your offerings

Digital product development can be one of the most exciting areas to establish new revenue opportunities. Getting your teams grounded in “who you want to be” will improve your chances of success and accelerate your teams by allowing them to focus on a clear concept.

Given that generating revenue growth is on almost everyone’s priority list, it may be the right time to start these types of conversations. But these topics might seem unfamiliar to enterprises in composability and digital transformation initiatives. MuleSoft has you covered. Read on to learn how to prepare your IT and business teams with a solid strategy and execution framework.