This post was written in partnership with Green Irony and Alexander Solomon, Lead Insurance Industry Marketing Manager at MuleSoft.

The rise of the digital consumer has led to higher expectations for every business. This shift has forced traditionally slow-to-adapt industries to modernize — or risk being left behind. For this reason, the insurance industry is undergoing rapid evolution. Early movers with the foresight to focus on investing in IT agility have been rewarded, while the clock is ticking on laggards to catch up.

To acquire and retain today’s digitally-driven customer, insurers must adopt a modern API-led integration strategy that fuels access to data when and where it’s needed.

Top initiatives of insurance carriers

The need to modernize is clear across the insurance industry. The top IT priorities for insurance carriers all focus on transformational initiatives:

- Process automation and optimization

- Single pane of glass view of the customer

- Personalized experiences

- Consistent omnichannel user experiences across web, mobile, and social

- Improved partner experience for brokers and agents

- New product development, rollout, and servicing

Each of these goals highlights the need for readily available access to data — which is not easy to accomplish in insurance. Data lives across a large swath of complex enterprise systems that were not engineered to facilitate easy access to data. Traditional approaches to data integration require lengthy and costly projects that are often obsolete by the time they finish.

Meeting these challenges requires a better approach to integration that focuses on development and enhancement of assets that enable insurers to invest in creating scalable patterns to facilitate access to all data. API-led connectivity is the key to success.

How an API-led approach addresses modern insurance integration challenges

To say that real-time access to data is a challenge for an insurance carrier is a massive understatement. A typical carrier’s IT landscape is the perfect storm for data access challenges:

- Heavyweight on-prem policy/billing/claims systems that are heavily-customized with poor out-of-the-box integration capabilities.

- Mission-critical reliance on third-party data providers with non-standard APIs and frequent issues and outages.

- Legacy hardware and software such as CICS mainframes, often with decades of technical debt.

- Accumulation of redundant, superfluous technologies, and platforms within the system landscape.

- Strict regulatory requirements on data security, governance, and archiving.

- State-by-state variances in regulations and products.

- Aggressive cross-channel digital transformation initiatives.

These integration requirements levy heavy demands on IT organizations. Without a comprehensive strategy centered on asset creation and re-use, carriers get stuck on the hamster wheel, writing, tweaking, and re-writing custom point-to-point integrations and exhausting IT budgets. API-led is the ticket off of this hamster wheel.

A great example that showcases the value of API-led centers around the reliance on third-party data providers when quoting new policies. When a homeowner’s policy is quoted, flood risk, past claims, the shape of the roof, whether or not there is a swimming pool in the backyard, and many other factors are considered. These risk factors are aggregated from third-party providers and analyzed as part of a risk assessment that determines the price of coverage. In total, many P&C carriers deal with 20+ callouts to retrieve the data necessary to quote a single policy. The legacy approach to integration called for wiring these callouts directly into the policy system.

This pattern has several disadvantages that are overcome with an API-led approach:

Legacy:

- All logic is encapsulated within the policy system, making it unavailable to other external workflows like those required by comp raters.

- Replacing a single data provider is a heavyweight endeavor and requires a three to six month project and a robust regression test strategy.

- Monitoring and pinpointing the culprit of an outage is time-consuming and error prone.

- Business logic changes are time-consuming and costly, requiring innate knowledge of the policy system customizations.

API-led:

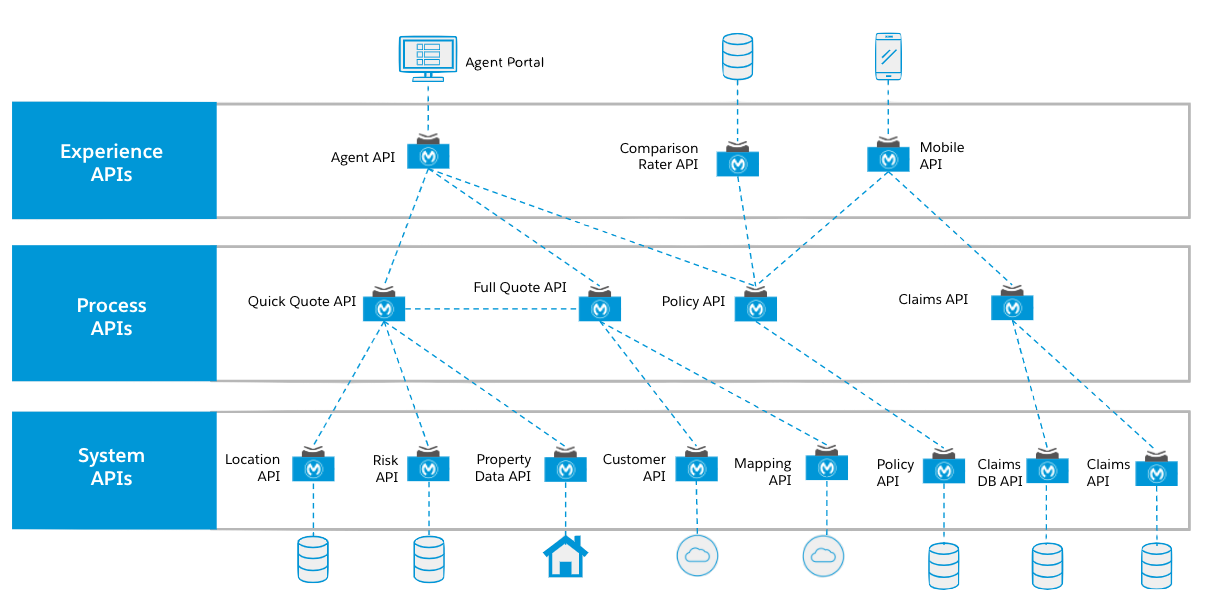

- Logic is available wherever it’s needed, and new comp rates can be added by creating a simple Experience API.

- Replacing a single data provider requires creation of a new System API on top of the new provider and then swapping it out.

- Application network monitoring immediately identifies the problematic API, eliminating time-consuming problem determination and isolating the problem.

- Business logic changes are encapsulated within Process APIs and involve tweaking the embedded logic in one place and rolling out a new version of the API.

With MuleSoft, carriers don’t have to tightly couple everything within the policy system. This loosely coupled strategy maximizes re-use of assets, minimizes churn, and allows forward-thinking CIOs to invest in an agility layer capable of meeting the rapidly-changing business requirements levied by today’s technology initiatives:

Building an API-led integration strategy on the MuleSoft Anypoint Platform provides the toolset, visibility, and composability needed to address every insurance scenario. Investing in this strategy provides the scalability needed to address future needs efficiently and economically without straining your resources and allows carriers to focus on critical success factors to their business: writing financially sound policies and servicing them with excellence.

Check out our three-step guide for insurance transformation.