Statue in Kipling, Saskatchewan, Canada commemorating the red paperclip that Kyle MacDonald used to start a series of trades that led to him obtaining a house in that town.

In a previous blog post, I explained how Clayton Christensen’s “jobs to be done” theory can be used to identify innovation opportunities that are enabled by API products. The CURE methodology from that blog post is the basis for the group exercise in the API Strategy Workshops we deliver worldwide. It’s a great way to determine which API products can improve your customers’ experiences with your offerings. That works well as a starting point, but to sustain the success of your API program, it’s vital to look more holistically at your business. For MuleSoft CONNECT 2020, Mike Amundsen and I are presenting a talk titled “Choosing the right API business model.” In this talk, we stress the importance of having your API products act as cogs in your organization’s business model. We needed a way to illustrate the role of APIs in digital business models, and to do this we went back to Clayton Christensen’s work.

One of the main concepts in Christensen’s The Innovator’s Dilemma is the notion of “value networks.” Christensen defines value networks as, “The collection of upstream suppliers, downstream channels to market, and ancillary providers that support a common business model within an industry.” To oversimplify the message of this fantastic book, an organization’s business model can be derived from its disposition within the value network. That same organization’s path to successful innovation is intrinsically linked to its value network. Sustaining innovations — the ones that allow incumbents to stay on top of their markets — come from optimizing their existing value networks. Disruptive innovations — the ones that topple leaders and give rise to new players — require the creation of new value networks whose momentum and maturity may attract stakeholders from other value networks. I encourage you to read the book for more on the topic of innovation, but for now, let’s just state: value networks are important!

Value networks and value exchange

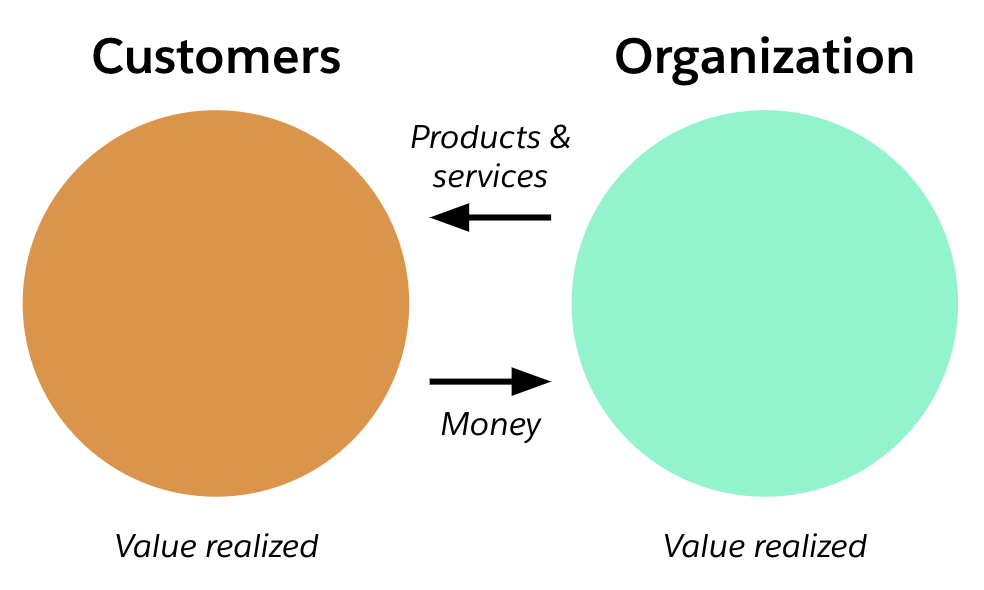

In the simplest view, networks are composed of nodes that interact with one another. In a value network, the nodes are the various stakeholders: the organization in question along with its customers, distributors, suppliers, and other partners. But what about the interactions that transmit value? Alex Osterwalder, creator of the Business Model Canvas, defines a business model as “the rationale of how an organization creates, delivers, and captures value.” From the value network perspective, value creation can happen within the nodes, but value is delivered and captured simultaneously between stakeholders in a transaction known as a value exchange. Exchanged value can be tangible — such as money or goods — or intangible — such as exposure or quality improvement. The following value exchange diagram is adapted from Melissa Perri’s excellent book on digital product management, Escaping the Build Trap:

Figure 1: A typical value exchange.

Depicting an organization’s set of value exchanges within a value network turns out to be a useful way to illustrate its business model. Furthermore, this approach can define business model patterns and archetypes that can be applied to new company and industry contexts.

Value exchange-defined business models

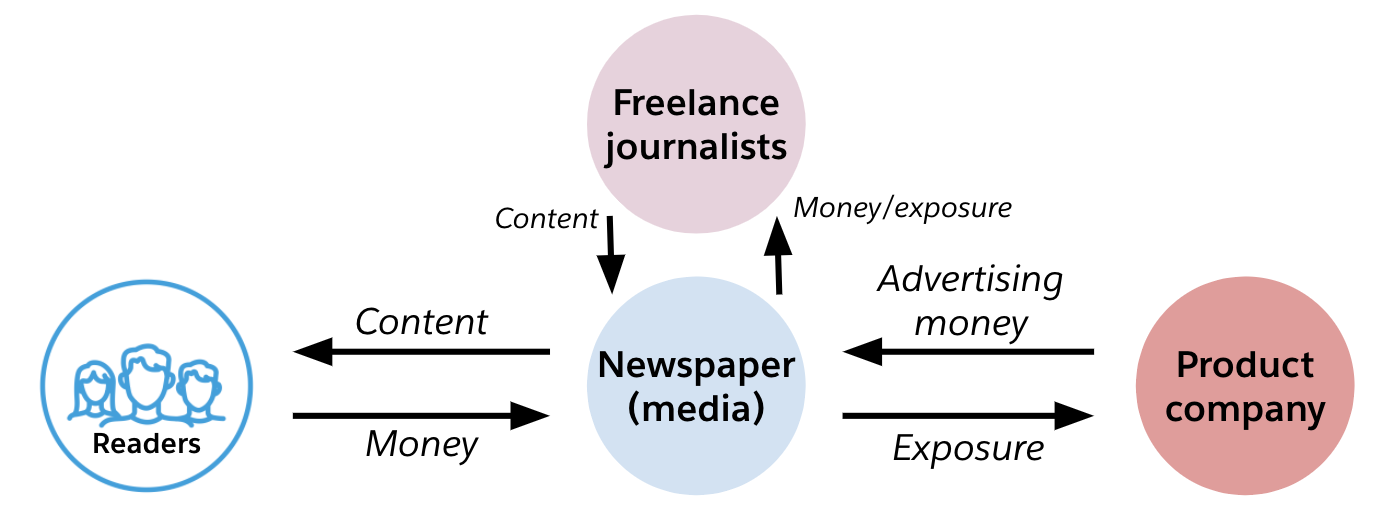

Take, for example, a business model that was successful for decades, but is now under threat: print media. The value exchanges in a 20th century newspaper’s business model could be drawn like this:

Figure 2: A newspaper business model depicted through value exchange.

The newspaper delivers value to customers in the form of content, and captures money in return. On the other side, the newspaper delivers value to advertisers in the form of exposure to its readers, and captures even more money as a result. The final value exchange is between the newspaper and freelance journalists it might hire, giving them money and exposure in return for exclusive content. In this century, this business model has been disrupted by the rise of social media. What does Facebook’s business model look like when mapped through its value exchanges?

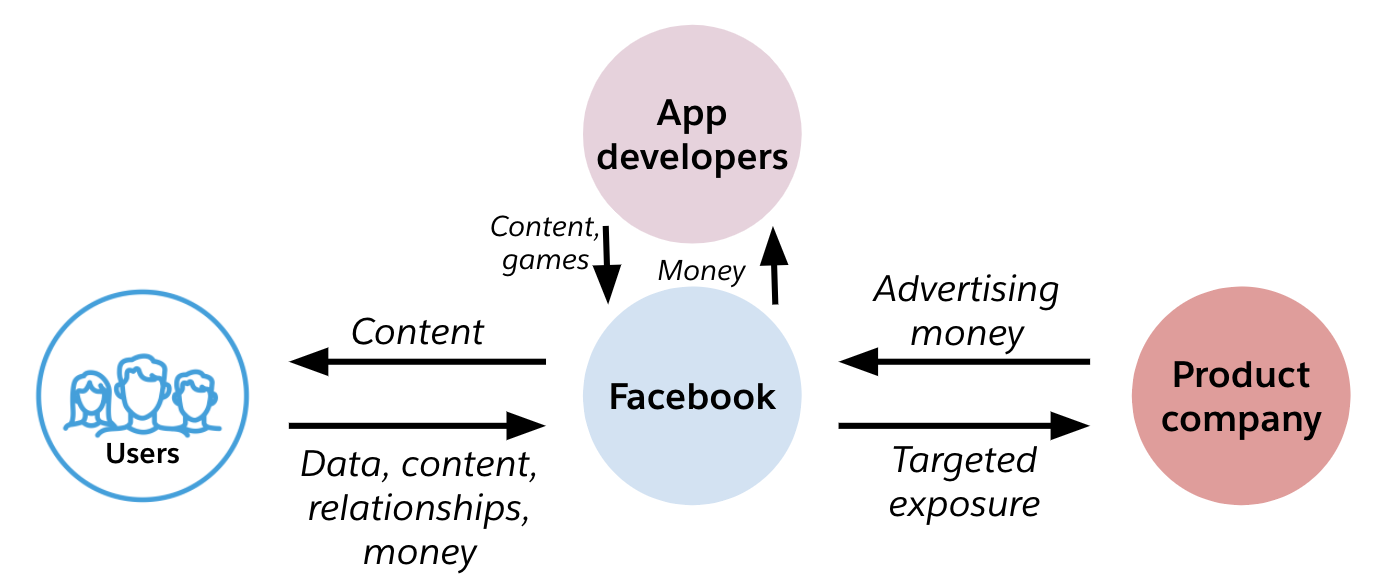

Figure 3: Facebook’s business model.

Interestingly, the business model structures are similar (isomorphic in mathematical terms). What differentiates them are the details of the value being exchanged. Facebook might capture money from its users in return for third-party apps or games, but the biggest value it gets from its users comes in the form of data and relationships that form a detailed personal profile. This profile information is used in targeted advertising, something that delivers considerably more value to advertisers than the anonymous advertising of the print media industry. Lastly, Facebook is even able to have its users — the content consumers — be sources of content themselves, leading to more time spent on the platform and more opportunity to present targeted ads. Clearly, the business model can be analyzed and measured by focusing on the value exchanges within the value network.

Digital value exchange through APIs

In the digital economy, APIs are conduits for value exchange. In the Facebook example above, Facebook’s APIs would be used by the app developers at the top, and possibly by advertisers on the right. Value exchange mapping is a great way to vet API product ideas by putting them in the context of an organization’s business model. To illustrate this, let’s look at two well known API products.

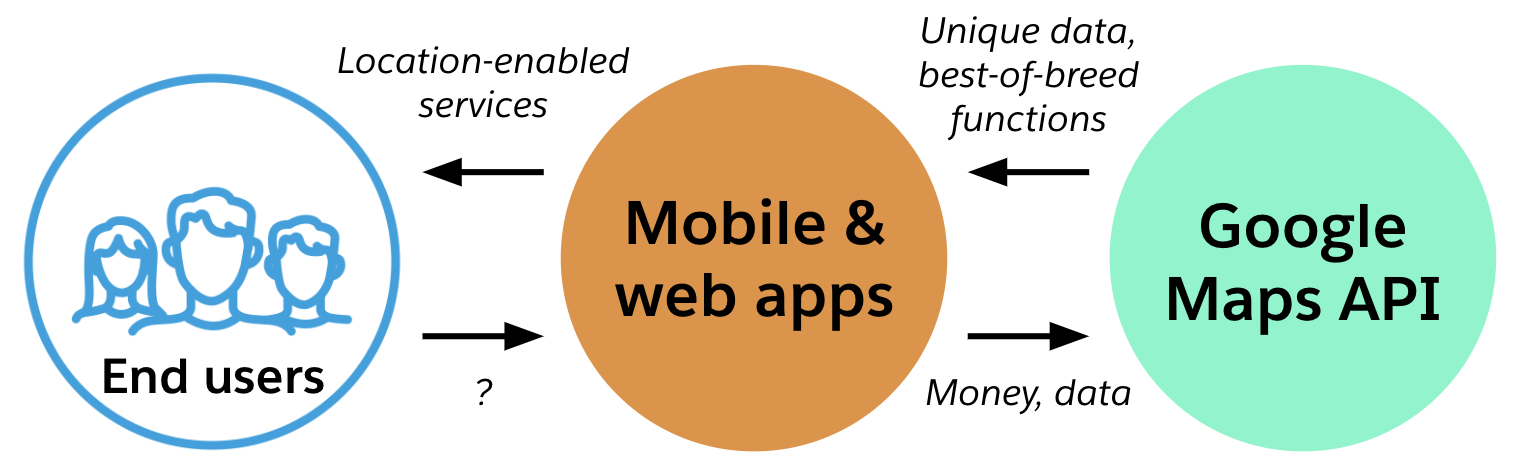

First, the Google Maps API is one of the biggest success stories of the API economy. Companies like Uber and Lyft would not have been able to launch without it. The business model is quite simple. Google Maps API consumers exchange money for unique geolocations services. Those consumers use the value they capture from the API to provide location-enabled services to their customers, who may exchange any form of value in return. The Google Maps API business model follows the “API supplier” pattern, since it mimics the way a supplier might function in the manufacturing economy, like a high-end stereo manufacturer for automobiles. There is one interesting detail in this business model that is specific to the digital economy. Google is getting more than just money from its API consumers. Every API interaction provides data that Google can contextualize and correlate with other data. This data can be used to create additional value for exchange in other areas of Google’s vast value network.

Figure 4: “API supplier” business model for the Google Maps API.

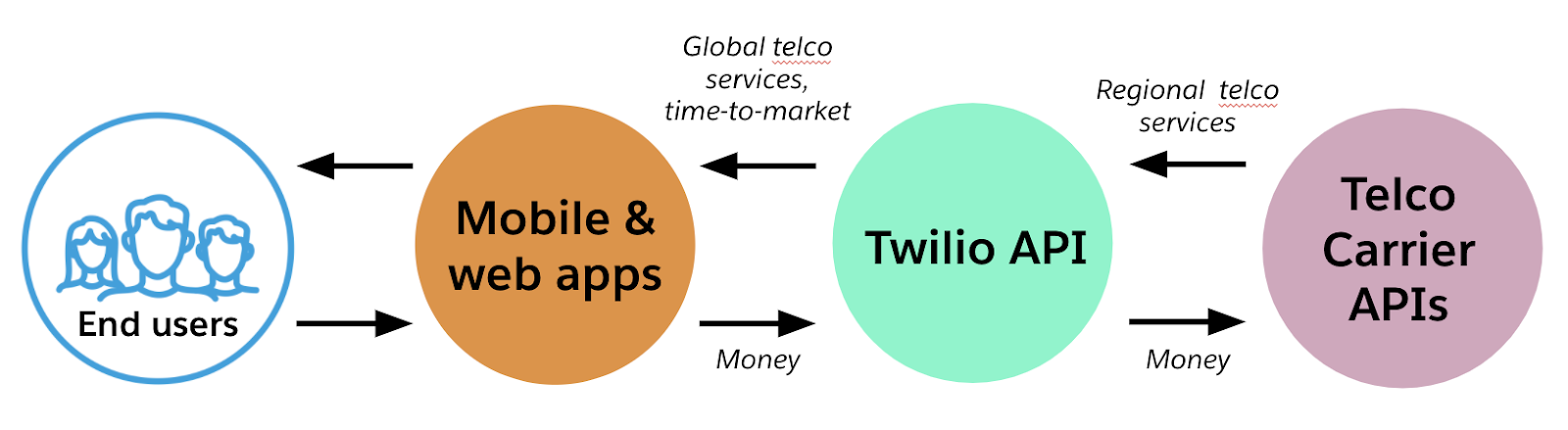

A more complex API business model example is Twilio. Like Google Maps, Twilio’s APIs grew substantially in support of the mobile application explosion that followed the launch of Apple’s app store in 2008. Recognizing that mobile app developers would need global access to phone- and network-based communications services, Twilio delivers time-to-market value to its API consumers by providing globally accessible telco services and superb developer experience. Its consumers have been happy to pay for this, especially early on in the app economy gold rush when time was money. On the other side of the value network, Twilio has a vast network of telco suppliers to whom it pays money in exchange for the services it aggregates. Twilio’s business model follows the “API retailer” pattern, since they are providing similar value to their consumers that a retail store might by targeting a specific group of customers and stocking their inventory from an array of wholesalers. Although they may not collect and synthesize data the way Google does, Twilio’s unique digital value comes in their understanding of how to appeal to software developers as direct customers.

Figure 5: Twilio’s “API retailer” business model.

This Twilio example starts to show the power and potential of the value network approach. Note how the telco carriers play the role of “API wholesaler” in Twilio’s digital supply chain. The mutually beneficial relationship and interdependence between Twilio and the telcos shows they are part of a broader digital ecosystem. I identify patterns of collaboration in the API ecosystem in a previous blog post, and will explore the relationship between API ecosystems and value networks in a future series.

Putting it into practice

Business modeling through value exchange is an excellent method for both identifying and vetting API product opportunities. The examples above are both fairly simple since they are scoped down to an individual API product in the case of Google Maps, and an API product company in Twilio. However, any company can use this approach to either assess their existing business models to find new digital opportunities, or assess specific API product feasibility based on their current value networks. I am excited about applying this technique in helping organizations capture business value from APIs. I am also heartened by the fact that others have been using a similar approach — such as The Value Engineers and their e3value methodolgy. Check out their value exchange map for the Netflix business model.

If you would like to learn more about value exchanges and how they can be used to choose the right business model for your APIs, make sure you attend one of our free global CONNECT events. I would be happy to virtually see you there. To apply these concepts in more detail at your organization, book one of our full-day API-as-a-Product Workshops, one of MuleSoft’s API Program Workshops. Take care and stay safe!