Financial services industry standards and file formats are unique and complex. There are different standards for low value payments, high value payments, international payments, bank statements, securities trades, derivatives, and stock custody transactions. In an effort to unify disparate formats based on geographic boundaries, industry utilities and market participants, the International Organization for Standardization (ISO) developed the ISO 20022 XML standard. The ISO 20022 standard was originally developed in 2004 and is an internationally agreed upon, global set of common standards for the development of financial services messages using a standardized XML syntax.

ISO20022 Migration Initiatives Underway

Adoption of ISO 20022 has reached a critical mass and implementation efforts continue to evolve. The European Union’s SEPA credit transfers and direct debits migration, completed in 2014, was the first high profile ISO 20022 standardization project. There are many other ISO 20022 migration initiatives underway across payments, securities, treasury, trade services, cards, and foreign exchange, including:

- Implementation of ISO 20022 formats for payments initiation by global corporates

- Canadian payments migration for low value, high value and EDI payments to Payment ISO 20022 message sets

- New payments infrastructure and ISO 20022-based fast payments service for low value Australian retail payments

- European TARGET2-Securities (T2S) initiative to establish a single platform for securities settlement

- Securities migration of ISO 15022 messages for funds to the ISO 20022 equivalent messages

- Adoption of automated messaging and ISO 20022 for DTCC corporate actions

- Introduction of 13 new ISO 20022 post trade foreign exchange messages

For many firms, migrating to these standards has resulted in custom-coded, error prone, point-to-point integration without dynamic validation of data elements and business rules. Instead, firms should considering partnering with industry-leading integration specialists to handle the most complex ISO 20022 data integration, migration and management challenges.

C24 Partners with MuleSoft

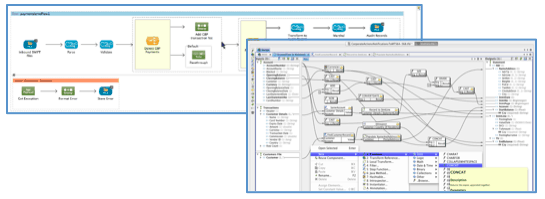

C24 Technologies has partnered with MuleSoft to enable MuleSoft Anypoint Studio users to easily embed financial messaging parsing, mapping, transformation, validation and enrichment into their integrations. The combination of Anypoint Studio and C24 Integration Objects (C24.iO) simplifies the development, implementation, testing and maintenance of financial messaging standards using model-driven tools and pre-built standards libraries.

To learn more about the combination of Anypoint Platform + C24 Integration Objects visit www.mulesoft.com/C24.