Tic:Toc, an Australian fintech company, has been working to create a fully automated online home loan application system since its conception in 2015. By removing inefficiencies in the home loan approval and fulfillment process, the company launched its platform in July 2017, enabling customers to easily submit loan applications online to receive instant decisions on their applications.

Automating common home loan process

Tic:Toc enables customers to abandon paper-based processes, offers more control with a smarter home loan, and ultimately delivers a full home loan approval in as little as 22 minutes. Compared with the industry average of 22 days, how is this possible?

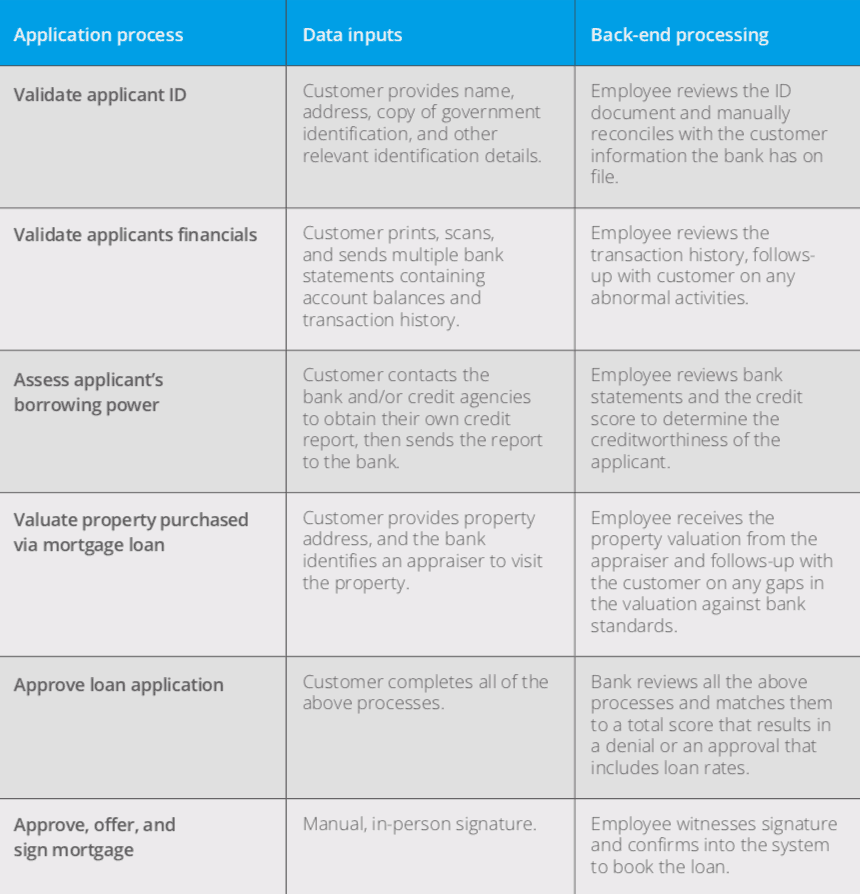

One of the biggest challenges with delivering instant home loan decisions lies in the complexity of the traditional process. For example, when validating a property purchased via a home loan, an applicant must provide their property address, the bank then identifies an appraiser to visit the property, the appraiser provides the property valuation to the bank, and the bank follows up with the customer on any gaps. What a long, manual process! The table below provides insight into other painful processes associated with loan applications:

To automate these, Tic:Toc used APIs to unlock core system data across CRMs, e-form applications (captures application data digitally from the customer), and e-sign systems (records signatures digitally). With APIs, Tic:Toc was able to automate previously manual tasks such as: property valuation, customer borrowing ability, credit background, etc. In the case of property valuation, for example, customers are able to enter the property address, then Tic:Toc integrates that data on the back-end with a property database that automatically calculates the property value.

Leveraging API-led connectivity to deliver an instant decision

Tic:Toc turned to API-led connectivity to connect the systems required to evaluate loan applicants, eliminating the manual submission process, and drastically reducing the amount of information that customers have to provide. As a result of this approach, the company not only reduced the loan application process from 22 days to 22 minutes, but has also received home loan applications valued at more than $2.15 billion. Due to its success, the company has ‘white-labeled’ the solution so that third-party partners can use Tic:Toc’s proprietary technology to power their own instant home loan.

To learn more, check out Tic:Toc’s case study. You can also read our Automating business processes using APIs whitepaper for similar stories.