We seem to roll from one major external impact to the next in a quickening cycle – all while continuing to meet customer demands. This is the sentiment from my customer engagements as we move from pandemic to endemic and look to the second half of 2022 challenges around the globe.

Digital transformation isn’t slowing – and the financial impact of its failure is significant

While the urgency and necessity to digitally enable organizations begins to evaporate, it’s a given that customers expectations have not reverted to pre-pandemic expectations. Workforces have more inter- or intra-state and customers are digital-savvy by default, yet much of the digital transformation is not yet complete.

Supporting remote work in the financial services and insurance industry

Finserv and insurance orgs need to support remote work for employees and an influx of new digital customers with increasing expectations for a connected experience. How can organizations do more with the same? How can IT leaders meet the business needs of their stakeholders?

Customers are selecting organizations based on their expectations. I recently moved to North America from Australia and had the opportunity to select all my banking and insurance relationships from new. I searched for their mobile app reviews, their ecosystem value in partnerships with adjacent services, and compatibility with financial services I wished to use. I was impressed with many of the existing integrated solutions they have in place and quickly moved away from those who lacked the user experience I desired. Brand loyalty is fragile, and it’s essential that organizations exceed their customers’ expectations.

I have the privilege to meet with many of our customers each week, and predominantly, the conversations are not technical but strategic. Current discussions with customers are not just how to achieve their goals. Instead, they include searching for partnerships, advisory, and leadership and how to reliably achieve their goals with agility over speed. They seek to remove integration as a bottleneck and add value to the organization by enabling their ecosystems (external APIs). All customers are seeking to deliver larger programs, but more importantly want to minimize regretful spend.

3 challenges financial services and insurance organizations face

Data silos, outdated IT infrastructure, and security and governance are the biggest challenges when integrating user experiences for financial services and insurance organizations.

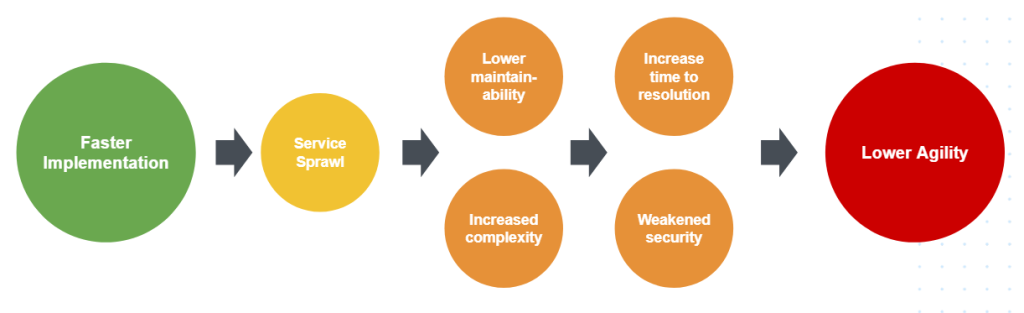

Because what customer wouldn’t want to have faster implementations?

Often integrations are seen as a “subsequent” phase of any program or implementation and as such, program management drives for “shortest time to delivery” to ensure the broader program is delivered to a schedule. This allows organizations to make strategic decisions implicitly, without consideration and by functions (PMO) not expected to do so. Why should integration be a secondary, tertiary after thought?

We use this visual as a key slide to frame my discussions. When challenged, customers actually want agility. They will afford the investment to achieve agility in the medium term when they have sight of the wider benefits to be realized. Our successful customers are realizing the value from their investment by second and third delivery.

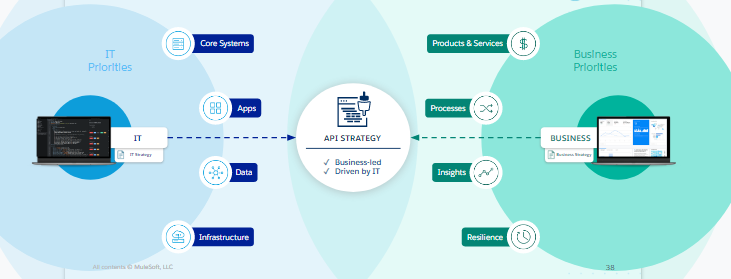

Plus, they’re realizing subsequent programs with great agility, and more importantly in this digital age, into new ecosystems and partners. Enabling and supporting digital engagements with customers, or indeed suppliers, requires an API-led approach. This is in fact the preference of consumers, and when highlighted, the preference of our customers. Having a defined interface and the authorization to use such an interface enables the surrounding business processes to function.

Financial services and insurance orgs turn to API-led connectivity and reuse for faster time-to-value and cost efficiency

Consider the humble 4×2 LEGO block. Most readers know they can connect that 4×2 block to another 4×2 block, a 2×2 block, an 8×2 block, or even a 1×1 block. Why can we assume this? Maybe you had LEGO as a child, or perhaps you gave your own child a set. It’s also a uniform object we understand in advance. So are RESTful APIs. But just like walking on those 2×1 blocks in the darkness of the night, APIs rapidly built in silos by developers or partners that are not published, shared, or governed will cause organizational pain in the future.

By having an API-first strategy, organizations can evangelize their business capabilities to developers in forms understood by other developers and support the life cycle of the partnership. By creating an asset that is more agile for the supplier to develop, manage, and secure, the burden of debt to integrate is transferred to the consumer.

This isn’t a trick of the supplier, but a two plus two equals five outcomes. Suppliers want the ability to innovate and deliver new capabilities to the consumers ready to accept it. Consumers want the agility to manage change to their own organization.

How to leverage the benefits of API-led integration

Let’s go through four recommendations to help overcome challenges of API-led integration while empowering business users, focusing on API reuse, tackling security and governance challenges, and creating a Single Source of Truth (SSOT).

The ensuing digital assets are typically termed API products. IT has and always will need to remind the business of the value they provide. As such, we talk of APIs and products because they are just that: they are a product the organization creates, manufactures, and delivers as a service to recognize value.

MuleSoft has a robust methodology and approach to measure the value of integration and APIs. Without calculating the impact with our customers, how can we validate we have delivered the value we know our customers can realize?

But what of agility? Building wrath’s of APIs is not a strategy. Building the APIs to meet the business needs is aligning business and IT strategy. Being able to adapt to change of existing solutions to external impacts will incrementally deliver value for your organization. Furthermore, doing so with a declining run/operating cost is the requirement of IT today. So it’s critical we aid our customers to deliver their API strategies.

Conclusion

Learn more about the state of digital transformation through a financial services lens in our recent report.