Picking up where I left off in my last blog on one global bank’s integration journey — this is an overview of how the bank realized immediate benefits of leveraging MuleSoft’s API-led connectivity approach.

The journey to a single mortgage-servicing platform

The first area to adopt Anypoint Platform was the bank’s consumer operations and technology group, which was on a mission to transform its mortgage-lending operations into a single mortgage-servicing platform. In line with central IT’s technology delivery transformation objectives, the goal of the project was to reduce operating costs, which were 50-60% higher than that of its competitors.

Despite having the largest market share in the industry, the bank faced high operating costs due to a highly complex, tightly coupled technology environment that had been created in-house and absorbed through a series of acquisitions of other mortgage providers. The IT landscape consisted of loan products on four different systems of record (representing the multiple mortgage lending business units the bank had acquired) and over 400 applications across multiple proprietary legacy technologies, many nearing end of life. The bank needed to retire over 300 applications, and to do so without affecting customers.

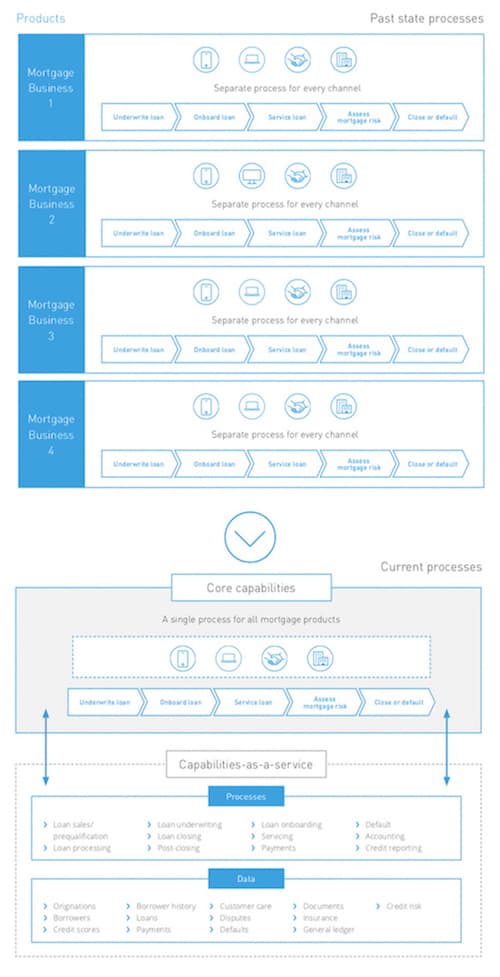

When it came to operations, each business unit had separate mortgage processes and systems, which required separate operational teams to support. Underwriting, loan onboarding, loan servicing, and other key mortgage processes varied whether a loan was with the legacy bank or one of its acquired firms. Customers were handed off between service providers who had only a limited view of the customers’ interactions with the bank. The experience was disjointed, and the lack of visibility made it more difficult for bankers to offer new products and services based on the customer’s borrowing history.

From a product-centric organization to a capability-centric platform

To address these concerns, the transformation strategy was centered around two main components:

- Implementing a single integration platform to develop and manage APIs and integrations as well as to assume the role of a single source of truth for all mortgage services.

- Simplifying the mortgage lending technology stack to reduce costs and achieve an end-to-end view of the customer.

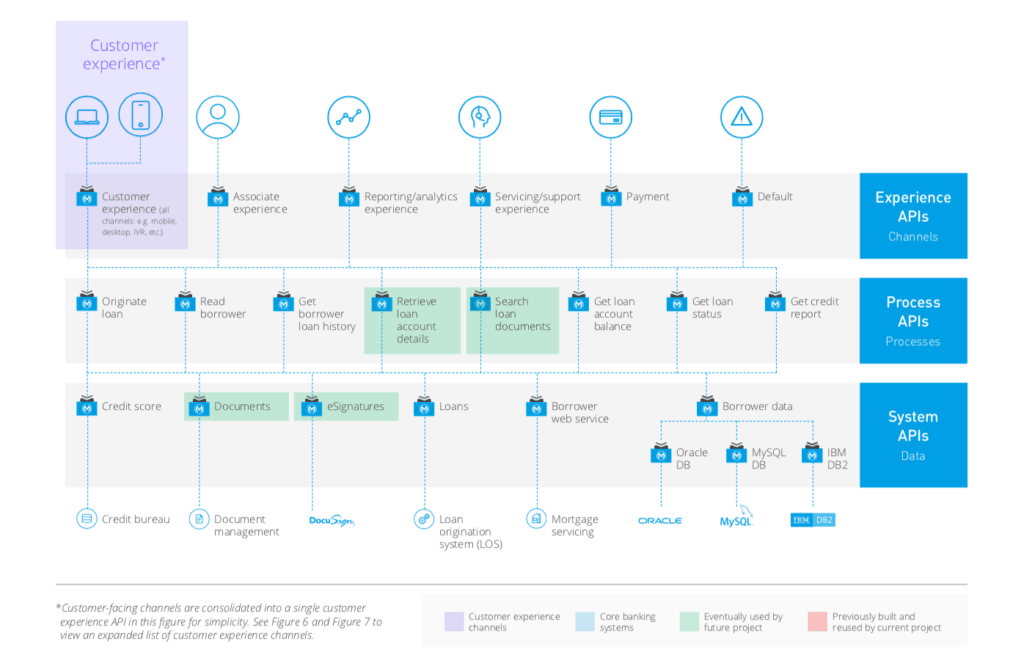

The bank leveraged Anypoint Platform and API-led connectivity to address both components of this strategy. The architecture diagram below illustrates how API-connectivity abstracted data and processes from back-end complexity.

The first step was to deliver a set of system APIs to unlock access to internal systems of record and decompose monolithic web-service functionality of external vendors into fine-grained services.

The bank began to realize value almost immediately. As the next set of developers began to self-serve the system APIs, they were able to easily bundle the APIs together to orchestrate mortgage processes. The ability to discover and reuse was critical. Many system APIs such as loans, borrower data, and documents were reused for multiple processes such as aggregating a customer’s loans or assessing the customer’s creditworthiness.

Mortgage processes were also packaged into discrete units. They manifested as process APIs. These process APIs were then consumed by all customer, employee, and partner-facing applications that were directly involved with mortgage servicing or with complementary functions such as accounting and credit risk management.

The results were inspiring. Through MuleSoft’s Anypoint Platform and the API-led connectivity approach, the consumer banking IT group was able to realize its vision of creating one mortgage-lending platform that would serve all business units with a standardized set of data and processes. This was a noteworthy shift: The bank had successfully moved from business unit-specific operations to a customer-aligned integrated experience for all mortgage activities.

The resulting asset inventory was also significant. Not only did the project team directly benefit from the reusable assets, some of the assets were reused by a number of other teams across the bank, which signaled the early emergence of the bank’s application network. For example:

- Retrieve loan account details API: This API allowed loan information to be consumed by applications built directly for the bank’s customers and customer-servicing groups, and to meet regulatory reporting requirements.

- Documents APIs: These APIs enable all electronic documents to be tracked and located. While initially built for mortgage loan documents, the bank recognized the APIs’ high potential for reuse by other functions; the APIs can also be used for difficult types of documents such as contract agreements, statements related to mortgages, check images, and other functions. As such, the bank subsequently spun off another project to rationalize document capture and processing across multiple lines of business into one solution.

- eSignatures API: This service integrates with DocuSign to accept digital signatures and store them in a secure repository; it can be used for multiple processes across the bank that involve contract signing such as account set up with new customers or procurement with external vendors.

The transformation of mortgage lending produced a significant business impact. As the application network provided visibility into mortgage data and processes, the bank was able to rationalize these processes to drive scale. The new architecture allowed the bank to retire duplicative services and applications, reduce compliance risk, and improve the customer experience. From a cost perspective, the bank reduced mortgage servicing costs by 30% with a run-rate annual cost savings of $100 million.

My next blog will detail the bank’s collections and recovery consolidation project. You can read our whitepaper to access the bank’s other Anypoint Platform success stories now.