The U.S. government relief programs in response to COVID-19 have put an unprecedented workload on the banking industry. The small business funding programs like Paycheck Protection Program (PPP) loans and Small Business Administration (SBA) Bridge loans have generated 14 years’ worth of applications in 13 days underscoring the importance of digital transformation.

A recent blog post on navigating financial uncertainty with connected digital banking offered three guiding principles that will empower banks during this trying time. Of those three, the first principle is to leverage API-led connectivity to digitize and scale lending operations.

In this post, we offer a solution to an example use case in support of that first principle. The example highlights the benefit of APIs to rapidly integrate disparate systems and the power of artificial intelligence (AI) in automating mundane tasks to accelerate the lending process.

Sample use case: The loan application

Let’s take the SBA loan application process. According to the Small Business Administration site, the life of an SBA loan has 17 steps, many of them require some kind of document processing and verification. Specifically, the front-end of the process, loan origination step, involves handling various forms and documents. For example, the PPP application requires 12 different documents including proof of payroll, ownership (Schedule K-1), rent, utility bill, and so on.

A simplified workflow of the loan application process is as follows:

- The loan applicant fills the web form on the bank’s site then uploads/email various documents.

- The uploaded documents typically are stored in some kind of cloud storage solution, like Box or an email server, in the case of emailed documents.

- The staff extracts, reviews (e.g. validate for local jurisdiction requirement and regulation), and saves the documents along with the customer record in a CRM system, like Salesforce.

- The officer then validates the document, evaluates risk, and submits the application to a back-end system for underwriting and decision.

While some of the workflow steps — like risk evaluation and decision making —may require loan officer intervention, most of the other steps involving document review and validation can be automated which the majority of lenders perform manually today.

How do we scale this process quickly? The volume of applications makes it impossible to scale with manual operations. The number of different systems involved in the process makes it hard and time-consuming to automate the process using the traditional point-to-point integration.

A better and strategic approach to integration is needed where we use consumable building blocks (i.e., APIs) representing various process elements that can be composed (as opposed to building from scratch) to serve the dynamic business demands i.e., an API-led approach.

Composing the process using APIs

Now let’s take a section of the loan application use case and apply an API-led approach to compose the process steps below. The APIs supporting the following steps are available in the Github project.

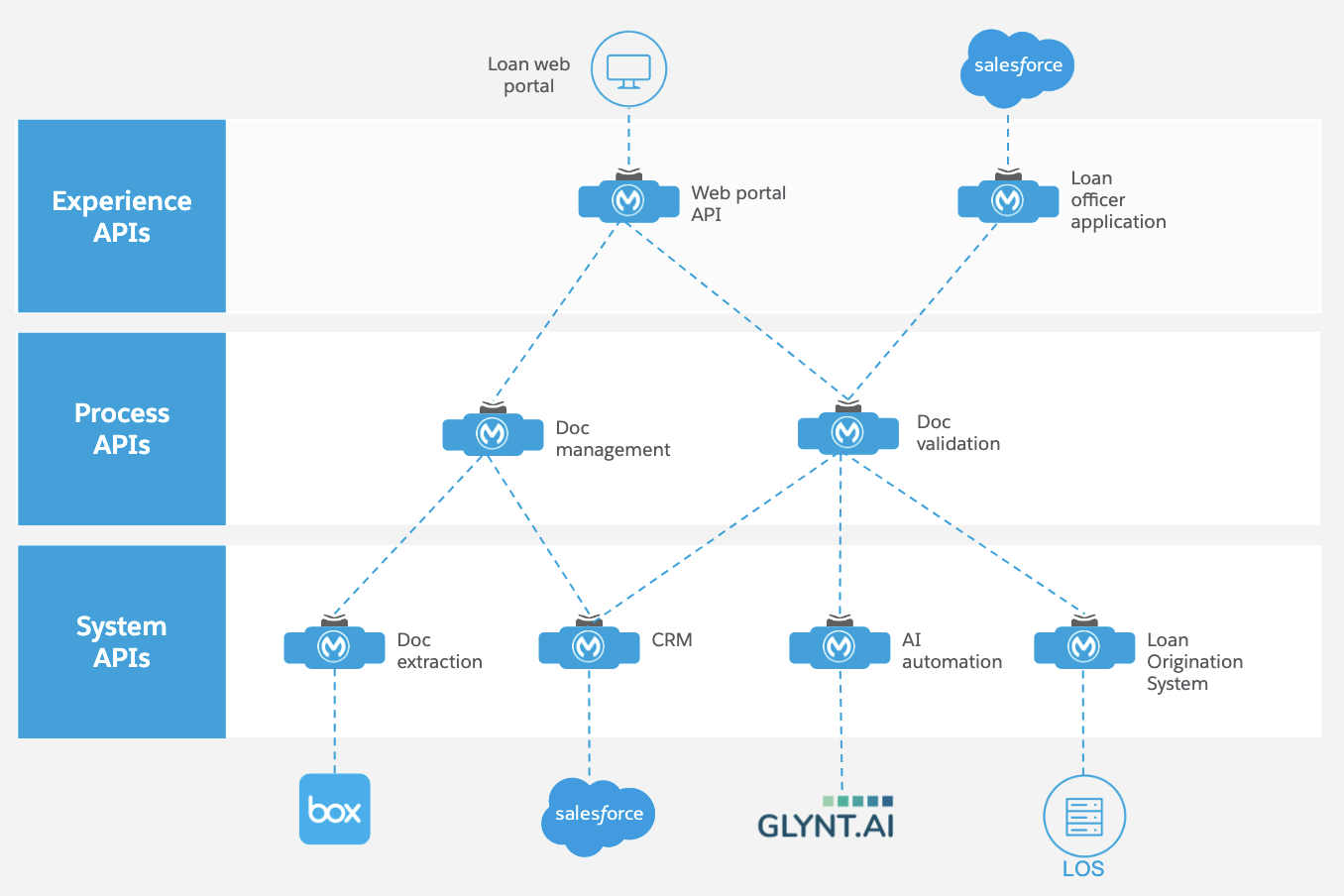

The API-led connectivity uses a methodical approach to connect data to applications through reusable APIs promoting consumption and self-service.

The first step is creating a system layer to unlock access to key applications. Here we use out-of-the-box connectors for Box, Salesforce, and the MuleSoft REST Connect to access data without worrying about the complexities of the underlying systems. The result is a set of reusable building blocks that can now be consumed over and over and composed into different business processes.

The second step creates the middle layer, also known as the Process Layer, that uses the System APIs to compose the following two processes:

- Document management Process API to extract and attach the loan documents uploaded from cloud storage to the corresponding account record in the CRM or a Content Management System (CMS).

- Document validation process API to automatically transform the document from a PDF or image format to machine-readable data using GLYNT, an AI solution. Then the data can be processed, validated against the business rules, and submitted to the Loan Origination System.

The Process Layer APIs are built to eliminate the manual steps so the bank staff can focus on high-value tasks like risk evaluation and handling special cases or exceptions. The result is the ability to handle high volumes at scale without errors and respond faster to customer needs.

Finally, the Experience Layer at the top can consume the Process APIs to expose appropriate information to the loan processing application and the loan application web portal.

Automate document processing with AI

While APIs are used to accelerate data and process integration, AI is used to automate the manual and arduous document validation process. Here we use GLYNT, an AI-powered no-code solution to transform a stream of documents into a stream of data. This solution is exposed as a set of REST APIs which is turned into a consumable building block using the MuleSoft REST connector.

At a high-level GLYNT uses a supervised machine-learning model which is first trained using a set of sample documents. Once trained, the model can be called on the actual document to output data in a JSON format. The document-specific model is automatically overlaid with a classifier model to further abstract the complexity of understanding individual document models.

Making the digital transformation journey

Digitizing loan documents and composing the loan application process using APIs could be the first step in improving customer response time and experience. Now customers can snap and upload a photo of the document using their mobile phone and get to the decision point much faster.

With the API-led approach now it is easier to extend support for a new channel like mobile or chatbot by just creating a new Experience API that leverages the existing process layer. For example, imagine the benefit of swiftly adding a chatbot channel to offload the call center load, with both the chatbot and call center rep using the same document data.

As the banking industry focuses on helping customer service with urgent financial needs, an API-led approach not only helps in accelerating lending operations but also lays a future-proof foundation for successful digital transformation.

For more discussion on this topic, tune in to our on-demand webinar: COVID-19’s impact to API strategies in financial services.