Businesses of all industries and sizes can understand the growing importance of a single, unified customer view. Financial institutions in particular are realizing the advantages of an aggregated representation of customers’ personal data and behavior such as previous interactions, history, purchases, etc. to better serve their customers.

The story I’ve been recounting of one global bank’s digital transformation is no different — around the same time that the bank’s collections and recovery consolidation project launched, it also set out to gain a single, integrated view of the customer. This was a major endeavor. Every line of business and hundreds of systems were producing or consuming customer data. In order to unify customer service across all lines of business and channels, the bank needed one common platform.

A single client and customer data platform

To begin, business units such as wealth management, consumer banking, and small business banking began to aggregate various customer data domains such as customer accounts, profiles, and relationships into separate data repositories. But the effort floundered as each team took its own approach.

After seven months and minimal success, the teams refocused on reusable APIs that could be shared across multiple groups.

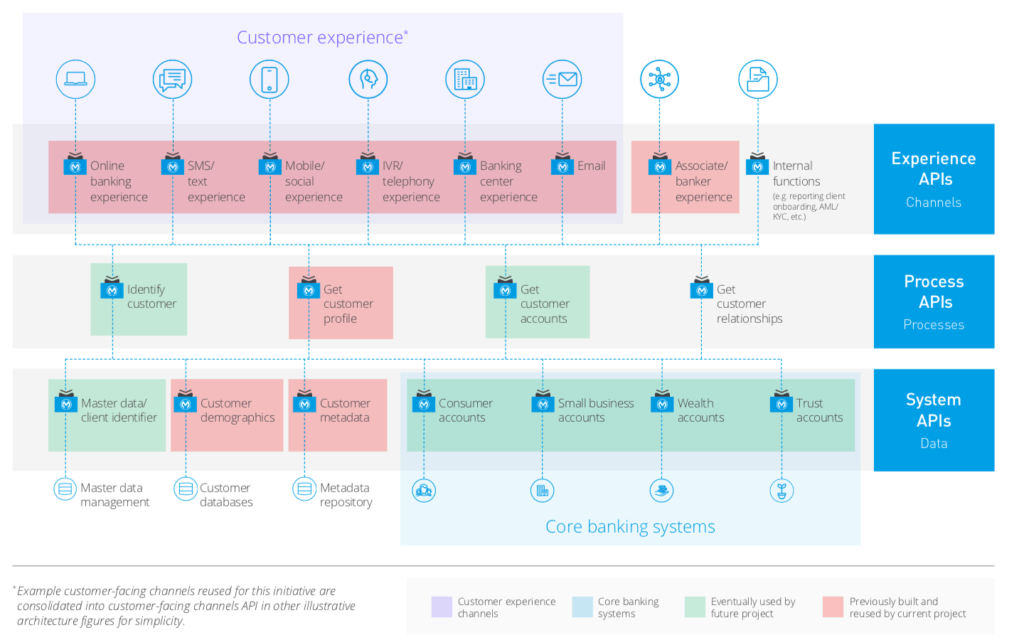

By embracing API-led connectivity, the teams were able to accelerate delivery by leveraging a customer metadata API, which allowed customer records to be linked across various systems of record, and get a customer profile API, which delivered a single view of customers’ profile information across a variety of sources in the bank.

Once it adopted this approach, the bank was able to achieve a single view of customers’ accounts, profiles, and relationships in three months. Instead of having to log into different web experiences, customers could log in once to view both their bank accounts and wealth-management accounts. Customer associates also benefited from having a single, consolidated view as they interacted with customers. They were able to access the data they needed to deliver meaningful advice and assistance across any channel.

Open Banking with API-led connectivity

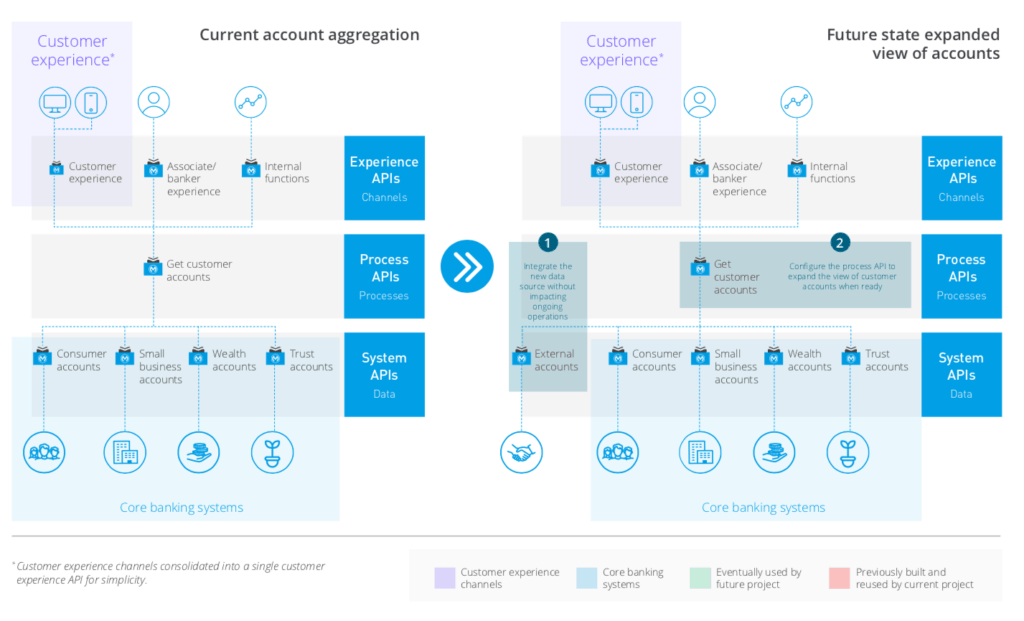

The adoption of API-led connectivity and the application network made the bank resilient to change. Now it can easily add new sources of account information without rebuilding current integrations. Instead, developers can just configure the get customer accounts API to incorporate a new data source. This ability to abstract channels from changes in processes and data sources will fuel the bank’s upcoming Open Banking initiatives. It is an example of how an application network compounds in value while enabling an organization to manage change effectively with minimal impact to ongoing operations.

My final blog in this series gives an overview of the bank’s fourth project – Salesforce Marketing Cloud and Sales Cloud integration – and the overall business results it realized with MuleSoft. You can read our whitepaper now for all the details on the bank’s IT transformation journey.