The COVID-19 pandemic has exposed gaps in banks’ ability to provide resilient, reliable payment services. Situations where banks could not process payments due to lack of staff access to physical data centers, or because of vendor-imposed downtime due to security breaches, have been all too frequent in the last six months. To address these challenges, banks must replace or augment their legacy systems and move processing to the cloud.

Addressing corporate onboarding challenges

One of the major pain points for banks — particularly as corporations — is how long it takes for banks to onboard corporate customers’ payments file and connectivity requirements. According to Aite Group, 74% of banks identify integration as the main obstacle to meeting their customer experience needs.

The problem is that banks often do not have the know-how or staff to deal with the variety of corporate file formats and protocols. Even if a bank has a “’standard” format they require the corporation to match, there is no guarantee that the corporation will be able to.

Volante Technologies is bridging this gap with its cloud-native, microservices-based payments solutions, and by working with MuleSoft to help banks of all sizes address their modernization challenges. In a recent MuleSoft webinar, Manoj Moorthy, a Senior Manager Project Management at Wintrust Financial Corporation, Nidhi Agrawal, a Principal Business Consultant at Volante Technologies, and Patrick Ikhifa, a Client Architect at MuleSoft, highlighted some of these approaches.

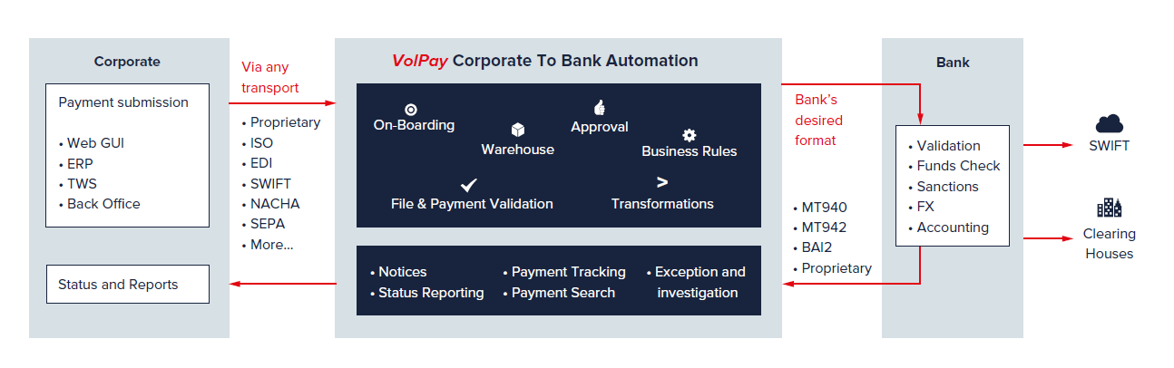

Wintrust solved their corporate onboarding challenge by deploying Volante’s Corporate To Bank Automation solution and MuleSoft’s Anypoint Platform. In this case, MuleSoft had a commercial set of clients who could only send specific industry-standard messages to Wintrust, such as converting a BAI to EDI format. Both MuleSoft and Wintrust were considering a partner who could help them with their current message transformation, as well as legacy modernization needs as they pertained to customer onboarding challenges. With its MuleSoft Certified connector, Volante was uniquely positioned to support this use case. Wintrust leveraged Volante’s universal format to onboard customers without worrying about compliance changes, proprietary formats, and standard format upgrades.

ISO 20022 modernization

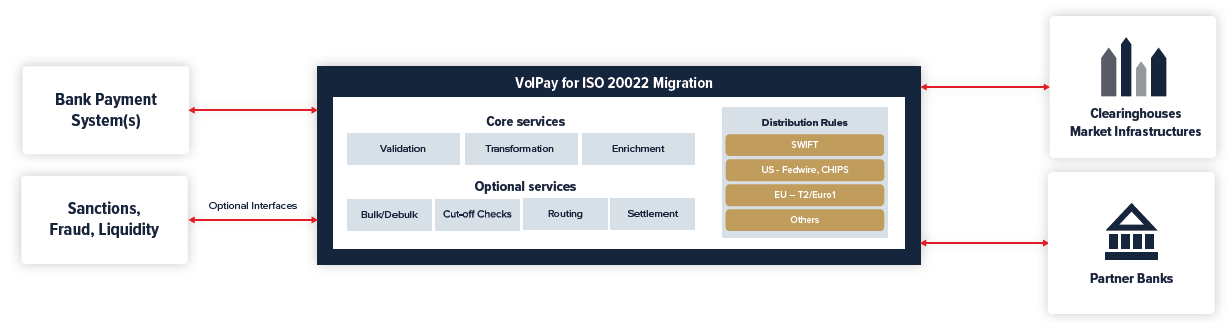

Another important area that banks need to address is ISO 20022, which is quickly becoming the standard for payment transactions. Unfortunately, many banks can’t currently handle ISO 20022 messages sent to them by their corporate customers, or can’t provide ISO 20022 acknowledgements back to them. When clearing and settlement networks like Fedwire® and TARGET2, or market infrastructures like SWIFT mandate ISO 20022-based messaging, banks often find that their legacy systems need considerable reworking to handle ISO 20022, which is oftentimes not practical.

Volante’s ISO2022 solution helps banks with their payments modernization for ISO 20022 without needing to replace their legacy core systems. The solution provides bidirectional transformation between legacy formats and ISO2022, whilst making sure no data is truncated. The messages are transformed for all bank integration layers (e.g. OFAC, funds control, etc.) to assist with compliance. The solution also comes with seamless ISO 20022 migrations and upgrades for all payment rails.

U.S. wire payments-as-a-service

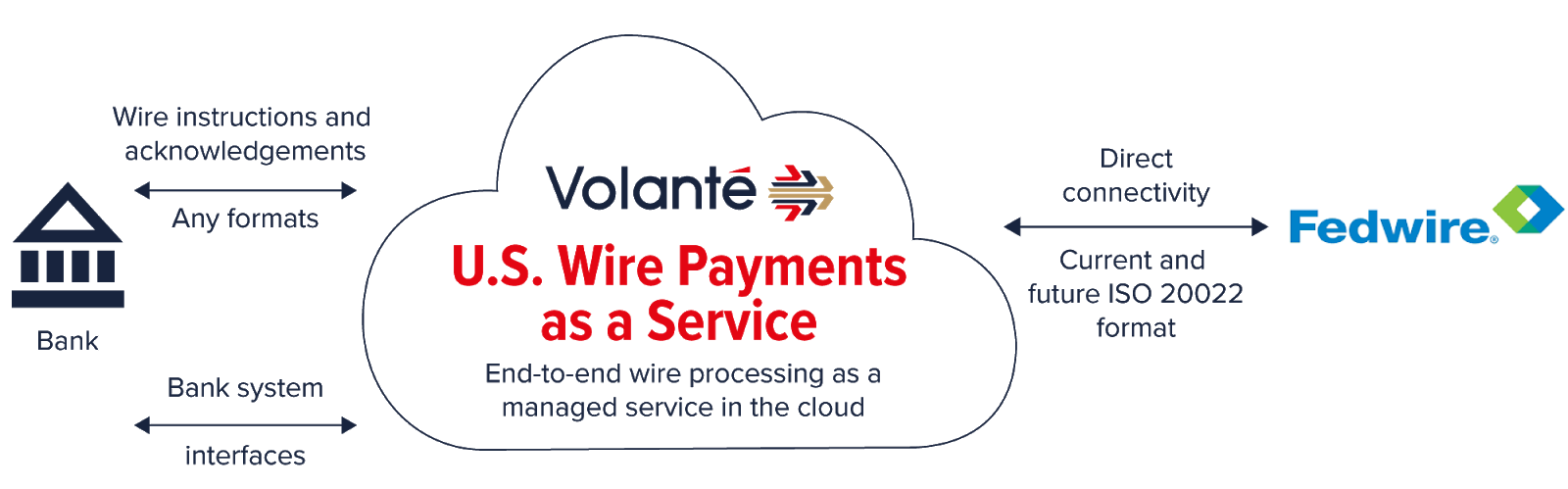

U.S. Fedwire® payments, also known as wires, are the payment type of choice for reliable, irrevocable large-value funds transfers — think mortgage settlements, or syndicated loans. It’s important that wire services have the highest possible resiliency and reliability. This year, banks’ legacy wire systems have come under pressure due to outages and unscheduled downtime, which has directly impacted the banks’ ability to provide mission-critical payment services to their customers.

Volante’s U.S. Wire Payments-as-a-Service provides banks with a fast track to modernization and a cost-effective solution to their resiliency issues by allowing them to eliminate legacy systems in favor of cloud-based processing service. Active-active-active deployment enables outstanding uptime, ensuring that wire payments are never missed, duplicated, or delayed.

The Volante and MuleSoft Partnership

Volante provides API-ready, microservices-based, end-to-end payment processing, and orchestration services, on or off the cloud. Volante also provides extensive libraries of payments and financial messaging standards and formats, for almost any type of payment anywhere in the world. MuleSoft’s Anypoint Platform provides best-in-class integration and API-enablement capabilities. Banks of all sizes can replace or augment their legacy payment processing systems and ready them for the cloud-based, API-enabled future by bringing the benefits of payments modernization to all of their customers. Learn more about Volante.

To learn more about the MuleSoft and Volante partnership, check out this webinar.