The benefits of applying the principles of SOA when catering to the IT needs of your organization are clear in a business-driven, vendor-neutral architecture. It considers all requirements from the perspective of the business process and delivers implementations in order to automate the same. The implementations themselves, driven by the same SOA principles and goals, are not bound to any one particular vendor because they are intrinsically interoperable, that is, they expose and consume Services or APIs (we use the terms interchangeably here).

The service, which is the building block of SOA architecture is reusable because it is agnostic to all business processes. It is effectively resused when it forms part of a composition, which typically maps to an abstraction of a business process. The SOAP standard has long been the backbone of SOA Service Interface design and continues to thrive inside the enterprise. An alternative standard in the form of RESTful Services has long been popular to engineers who prefer its simpler, more lightweight approach to the same problem. Regardless of the type of Service, SOA recommends governing and managing your initiative so that the reusable services do actually get reused and that the recurring logic typically needed to host these (security, quality of service, compliance, etc.) can be applied in the form of centralized and resusable policies.

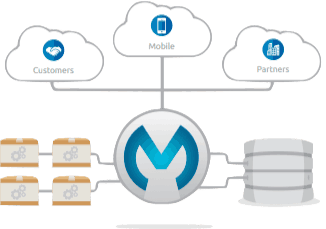

As the New Enterprise enthusiastically embraces the vast array of discreet software solutions available in the cloud, it now seeks to leverage the single factor which has brought about the huge success of all of these SaaS offerings: their API-first approach. Building on the wisdom and solid principles of Service Oriented Architecture, the New Enterprise exposes RESTful Web APIs which can be consumed by the various channels of business (mobile, web, office, partners, resellers, etc.). In this way, it exposes its core business as a service, perhaps consumable in unforeseen ways beyond the enterprise! Thus, the suite of services and the orchestrations that invoke them can be easily leveraged and put to new use by facading them with a simple RESTful API, easily consumable by the client apps used in each of the channels.

With this post, I’d like to introduce you to the Anypoint Platform for APIs, which caters to the entire lifecycle of service and API design, development, deployment and API management – all on a single platform. We do so by showing how Anypoint Platform can cater to an omni-channel initiative within a retail business.