In the midst of a top 10 global bank’s central IT transformation with MuleSoft, it began to realize the benefits of an application network. This blog will cover how the bank developed a strategic approach to expand its network, launching a new initiative to integrate multiple instances of Salesforce Marketing Cloud and Sales Cloud to drive new business.

What is an application network?

Before we dive into the bank’s CRM integration approach, here’s more context on application networks: An application network connects the applications, data, and devices within an enterprise and external ecosystems through the development and consumption of standardized services that are accessible through APIs. Instead of connecting applications through custom connections or isolated architectures, an application network provides the infrastructure for information exchange by wrapping systems with reusable APIs that others can discover and consume to connect. It is through the network of APIs that an application network emerges and evolves.

An application network can start with two applications connected by APIs that enable the two systems to share information (this would be a very early or nascent application network), and it can grow to an endless number of systems connected by APIs. Every new node added to the network increases the value of the network because the data and capabilities of that node are discoverable and consumable by others inside and outside the enterprise.

CRM integration with Anypoint Platform

According to an SVP at the bank’s CTO Office, the immediate benefits the team saw with Anypoint Platform resulted in this new project:

“After our initial successes, my team internally decided that we would work with the architects on any subsequent project to recommend a single platform strategy. So the template we have now is, start with one platform, then scale.”

Prior to leveraging MuleSoft, the bank’s customer relationship management processes and data were locked up in a point-to-point integrated technology environment. Multiple lines of business had their own views of marketing data that did not talk to each other. Recognizing the limits this was placing on their ability to serve customers, each group individually submitted engagement requests to IT.

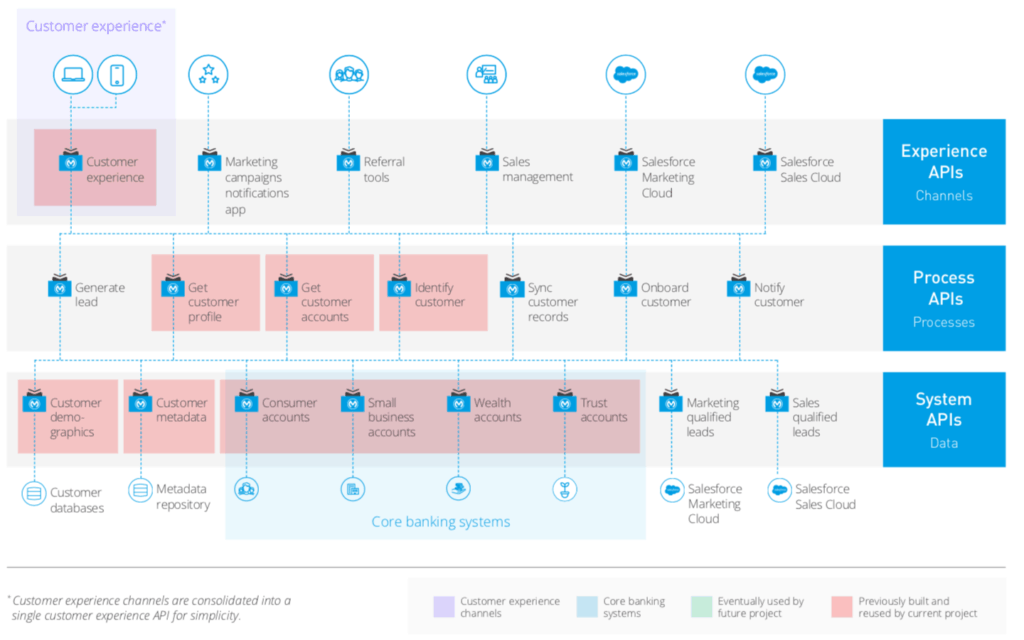

From the onset, the project had a wealth of assets from earlier initiatives to build upon. Customer demographics, customer metadata, and customer accounts across consumer, small business, and wealth management were already accessible through the customer data platform. The team responsible for integrating Salesforce was also able to leverage process APIs to get customer profiles and aggregate customer accounts.

The results

With a unified marketing and sales platform, the bank’s Salesforce instance worked with the client and customer data platform to consolidate data-driven, personalized email marketing, mobile messaging, and one-to-one communications. This provided a holistic view of interactive efforts and central administrative control for reporting and analytics, as well as managing opt-outs for CAN-SPAM compliance.

The bank’s digital platform supported two capabilities: client and customer relationship management as well as marketing and sales. These capabilities complemented each other to create superior customer experiences. For example, if a new customer record was created in Salesforce, it could be synced in near real-time with the sync customer records API, replacing what used to be a nightly batch process. Bankers could see when a new customer was set up so they could start developing customer relationships sooner.

The initiative not only empowered lines of business with more complete customer data, it also greatly expanded the value the bank realized from Salesforce. As one of the architects of the project reported:

“Because of the lack of integration, automation, and real-time data consumption capabilities, the bank was only using about 25% of the capabilities for which it was licensed for from Salesforce. By enabling Salesforce through the application network, we are able to get maximum benefit out of our customer-success platform.”

The above illustration showcases how, through four key bank initiatives – a mortgage lending transformation, a collections and recovery consolidation, a client and customer data platform project, and marketing and sales integration – the bank’s application network compounded in value.

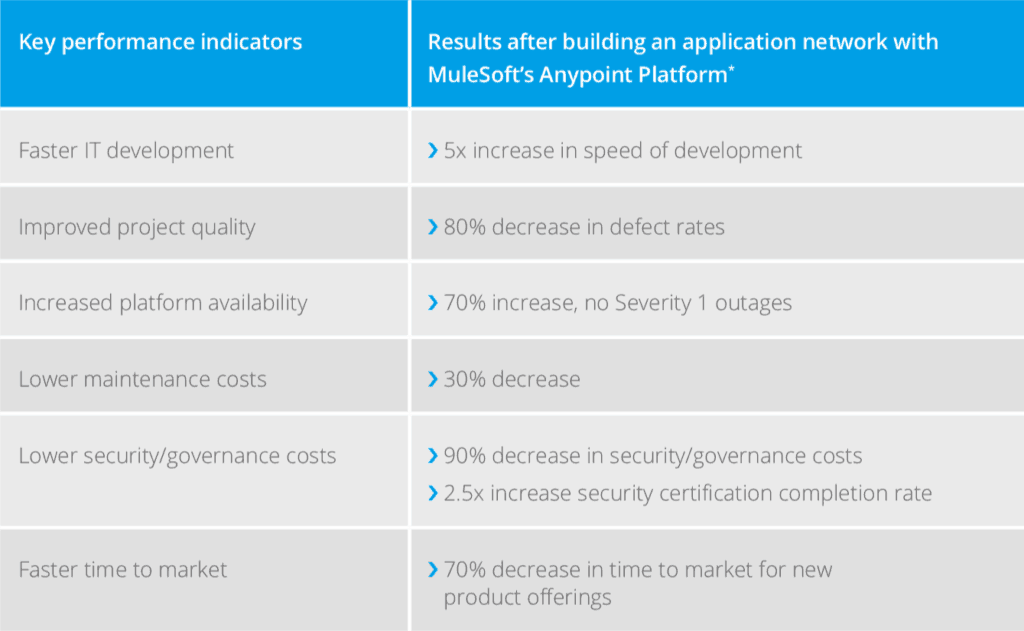

As the bank’s application network grew, it also saw gains in productivity, quality, performance, and speed to market. This enabled the bank to leapfrog its competitors in customer experience and drive substantial business outcomes including reduced costs, streamlined operations, increased speed and agility, and increased revenue.

To get in-depth insights as to how the bank enabled Anypoint Platform adoption at a scale with a C4E, download our whitepaper, Top 10 global bank drives 5X faster IT project delivery with an application network.