OakNorth’s journey from the first cloud-based commercial bank to the top 1%

We’ve seen several trends gathering steam in the financial services sector in the past year, as Carole Layzell, Senior Director of Customer Transformation at

How to unlock the potential of open banking with API ecosystems

Since the inception of the Payment Services Directive (PSD2) in Europe, open banking has presented both a compliance challenge and an opportunity to unlock

How to transform the banking experience for small businesses when they need it most

As consumers, we all have experienced massive shifts in expectations — we are no longer loyal to brands, but rather to the best consumer experience.

How TAB Bank unlocked its core banking platforms to transform the customer experience

Foundation for success Given the current disruptions in the banking industry, delivering truly personalized experiences requires incumbents to transform their digital strategy. TAB Bank,

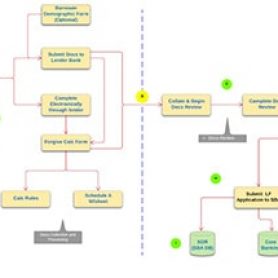

How to deliver small business support faster with a new SBA lending framework

The Paycheck Protection Program (PPP) has been a cornerstone of the U.S. government’s relief efforts for small businesses suffering from the economic impacts of

Accelerate your open finance strategy with MuleSoft and Plaid

As consumers have adopted third-party digital apps and services to better manage their financial lives, open finance has become a critical digital transformation priority

Help customers navigate financial uncertainty with connected digital banking

This post was originally published on the Salesforce blog. Banking providers around the world are helping millions of people and small businesses manage tremendous

Banking on a composable future in a mobile-first world

The global lockdown has forced society to rely more heavily than ever on digital channels in 2020. Those who still preferred face-to-face interaction in

How a global bank created a single view of its customers in 3 months

Businesses of all industries and sizes can understand the growing importance of a single, unified customer view. Financial institutions in particular are realizing the

Top 5 financial tech trends

Discover the top five insights realized by IT leaders in financial services organizations as they undergo digital transformation. (more…)