Insights from a VP’s customer engagements: Digital transformation in financial services

We seem to roll from one major external impact to the next in a quickening cycle – all while continuing to meet customer demands.

Insurance dives into the omnichannel opportunity

The search for insurance begins online. More than 69 percent of insurance shoppers ran a search before making an appointment with a broker and

4 steps for open insurance digital initiatives

A few days ago, we hosted Dave Ovenden, Managing Director of Pricing, Products, Claims, Underwriting, and Insurance Consulting & Technology with Willis Towers Watson

The modern insurance carrier: Delivering results with APIs

This post was written in partnership with Green Irony and Alexander Solomon, Lead Insurance Industry Marketing Manager at MuleSoft. The rise of the digital consumer has

How to enable a single source of truth with MDM and integration

A primary growth vector on the mind of many CIO’s today are mergers and acquisitions. And many of these CIO’s are in charge of

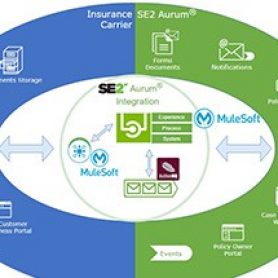

Automating life insurance using API-led connectivity

SE2 is a technology vendor providing insurance software-as-a-service to its customers. SE2’s main product is the SE2 Aurum® Platform. To ease the buying process,

3 ways our customers are using APIs to build future-proof businesses

The line between technology and non-technology companies is being blurred as businesses are looking more and more to create winning customer experiences through digital

3 steps to unlock connected customer experiences in insurance

The insurance industry is operating in an age of radical disruption. Traditional insurers are no longer safe, with insurtechs challenging incumbents to rethink their

Joining the insurtech revolution

Despite the insurance industry’s reputation as a laggard when it comes to technological innovation, it is undergoing massive change as traditional providers race to

How one IT leader measures the business value of IT

In part one of this Q&A series, I sat down with Jeff Rauch, vice president of IT at ICW Group, a leading national insurance